Where Exactly Are These Cockroaches?

Jamie Dimon, the longtime CEO of JPMorgan, is not known for holding back.

During the bank’s Q3 earnings call earlier this month, he referred to subprime auto lender Tricolor as a “cockroach,” suggesting it might not be the last troubled name to surface. Meanwhile a much larger company, auto-parts maker First Brands, has also come under scrutiny. Both companies have been widely linked to the private credit market in recent reporting.

So what exactly is driving these headlines, and should investors prepare for more cockroaches?

Why Are Investors Scared?

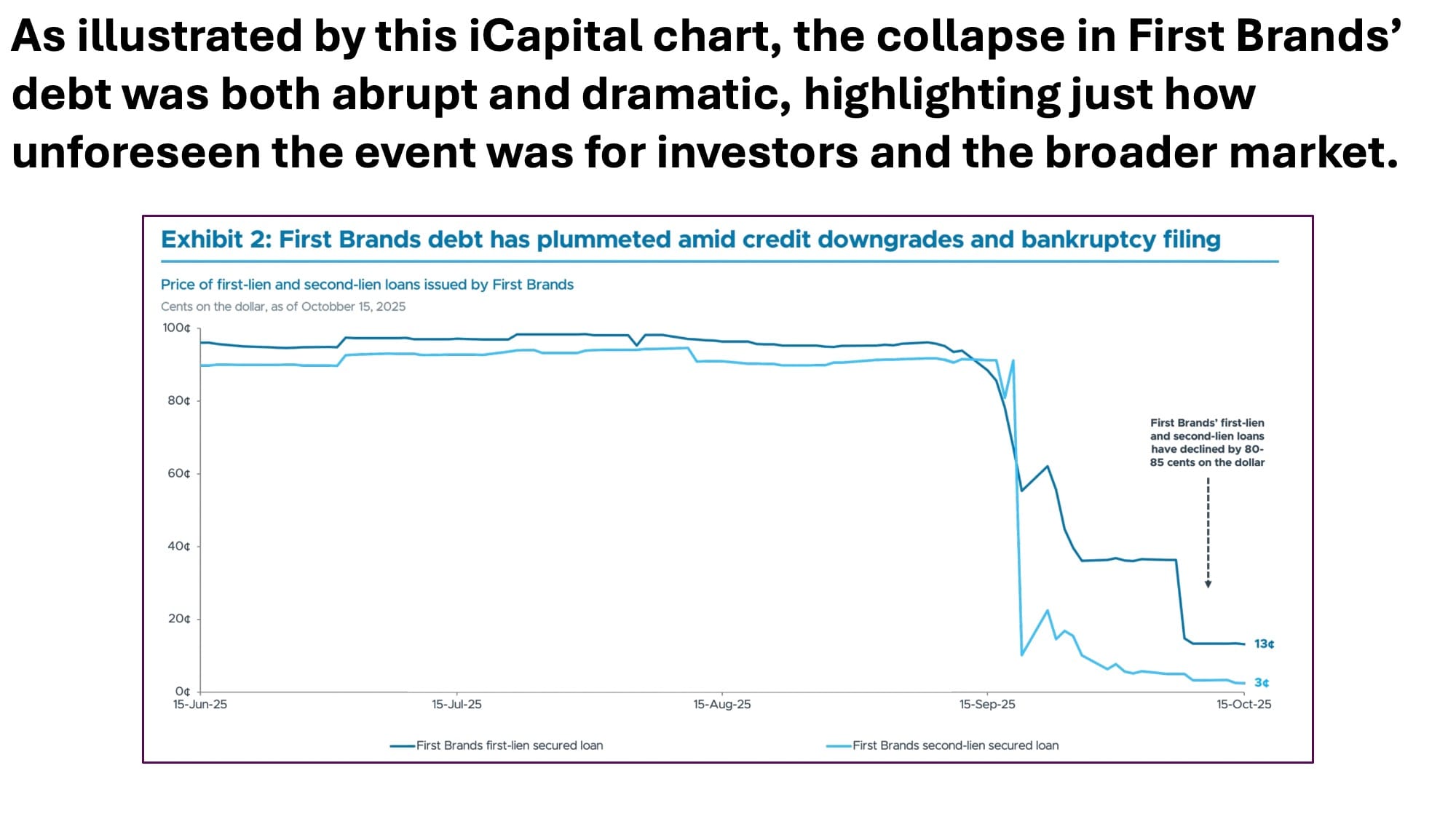

Both Tricolor and First Brands declared bankruptcy in September and are now facing serious allegations of fraud. In the case of First Brands, federal investigators and creditors allege that the company engaged in accounting manipulation and sold the same accounts receivable to multiple financiers, leaving more than $2 billion unaccounted for. Meanwhile, subprime auto lender Tricolor’s collapse followed revelations of double-pledged loan collateral, data irregularities, and widespread misrepresentation of borrower profiles.

While Tricolor's creditors are almost exclusively banks, several private credit funds hold exposure to First Brands debt, and that’s precisely what has investors on edge. The collapse revealed how weak underwriting and oversight left lenders blindsided, and investors are worried about more such stories emerging.

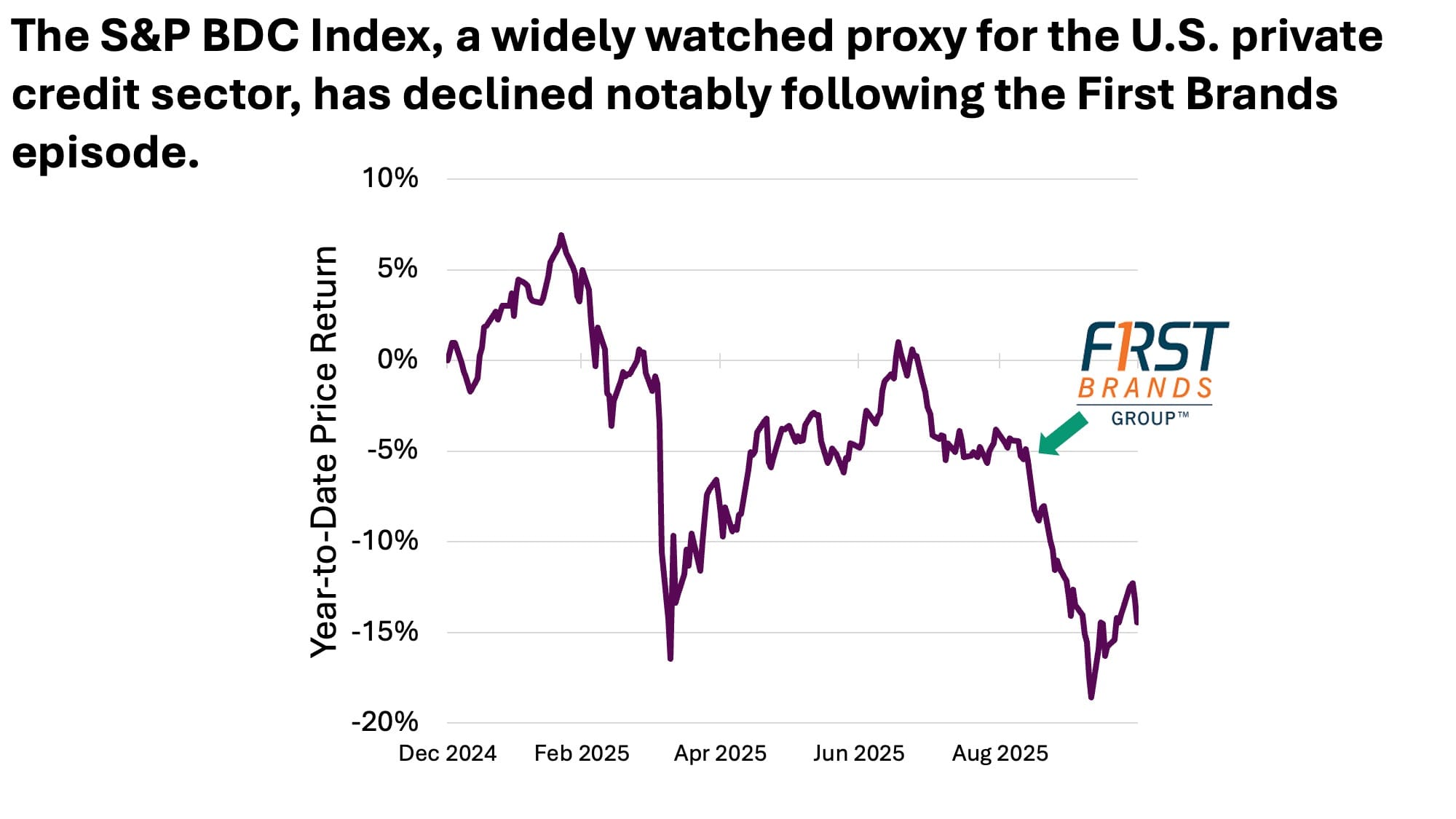

As a result, Business Development Companies (BDCs), often seen as a gauge for private credit, have traded lower in recent weeks as investors brace for potential ripple effects.