When Private Markets Goes Wrong - Bluerock and Willow Wealth

Anyone who’s heard me talk about private markets, or read my newsletter, might incorrectly assume I’m bullish on every opportunity in the space. But that’s far from true. Just like in public markets, private markets contain both good and bad investments.

And in recent years, many of the biggest problems have come from the real estate sector. Rising interest rates have weighed heavily on valuations, and some areas (most notably office) have faced additional pressure from structural shifts. This has not only hurt investment performance, but in a handful of cases has led to restrictions on investor redemptions.

But in 2025, two bad stories in particular stand out, and when evaluating private markets investments, it's critical to draw lessons from the worst actors. So with that said, it's worth taking a look at two of them.

Bluerock: That's One Way to Solve a Redemption Cue...

Bluerock is a real estate manager that oversees a $3.6 billion private real estate fund, and that fund has had some serious issues. For starters, investment performance has been poor. Over the 10 years to September 30, 2025, the fund’s Class I shares (the lowest fee share class), returned 4.28% per year, well below the FTSE Nareit U.S. Real Estate Index at 6.5% over the same period.

A key driver of this underperformance was poor liability management, with the fund relying heavily on expensive, short term debt to finance long term real estate assets. Private markets heavyweight Cliffwater highlighted some of Bluerock's problems here (without addressing Bluerock by name).

As summer 2025 rolled around, the fund had been dealing with an ongoing redemption queue, and over the prior two years, its asset base had already been cut roughly in half. Since the fund could not meet ongoing redemption requests, management proposed converting the vehicle from a private fund structure into a publicly traded REIT, shifting liquidity provision from the fund level to the stock market.

On paper, the idea has some appeal: investors seeking liquidity would no longer wait for the queue to open, and could sell their shares in the open market. With the queue gone, the portfolio could be managed more flexibly, potentially enabling more opportunistic deals and better long term performance. With the REIT listed, it could access lower cost financing, streamline expenses, and ultimately support higher distributions. These arguments were enough to entice unitholders, and the proposal was approved in December.

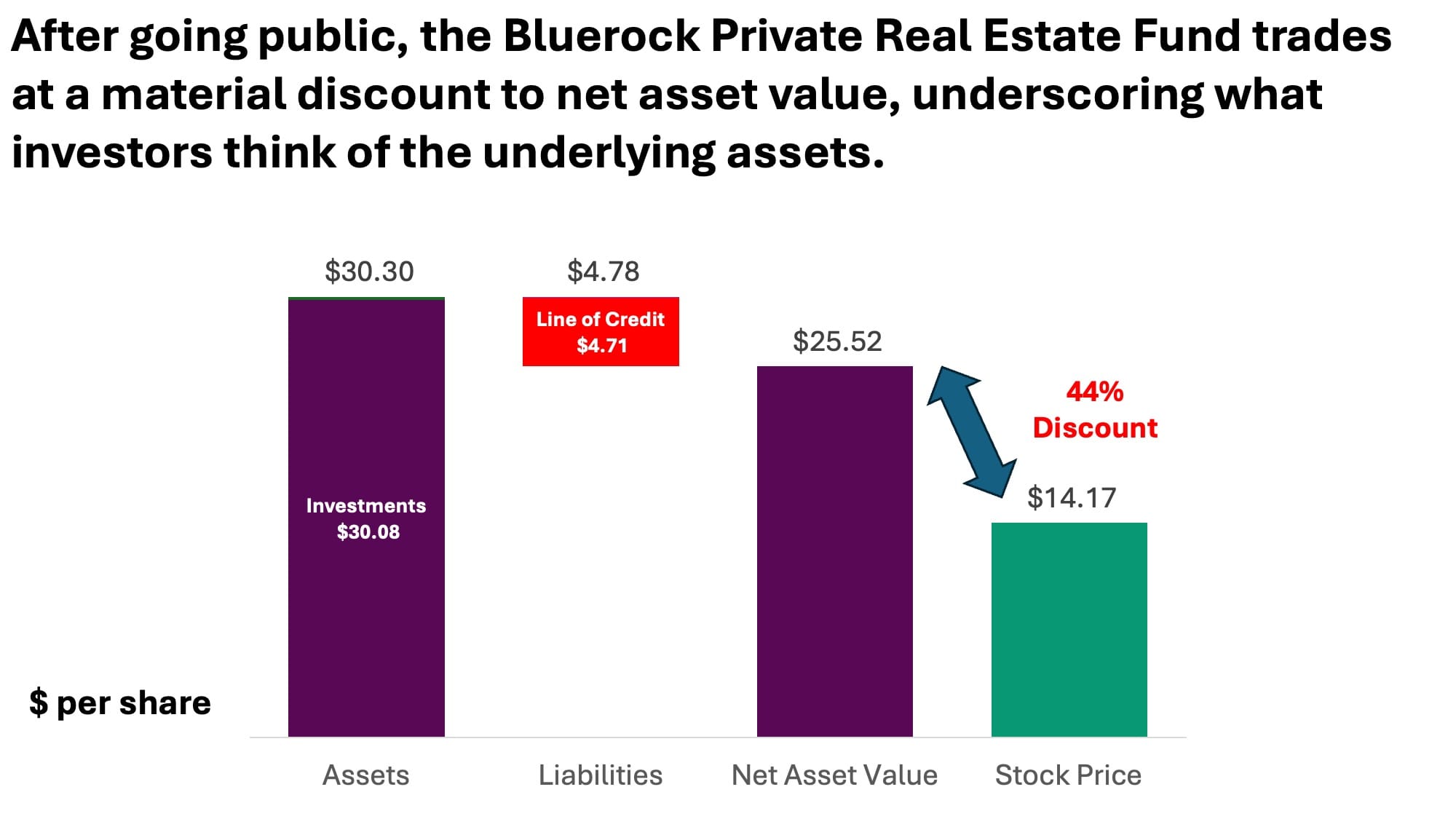

But this proposal has drawbacks too. The newly listed REIT begantrading on Tuesday this week, and as of mid-afternoon the stock price was about 40% below the fund’s stated net asset value. So investors can exit immediately only by accepting a steep discount to the value Bluerock assigns to the properties. The new structure also entrenches the existing management team and their lucrative fee arrangement, which does not adjust downward despite investors’ losses. So investors who sought diversification and downside protection in private real estate are instead looking at a large loss in a public stock they never planned to own.

Yieldstreet Willow Wealth: A Very Big Fall Indeed

Yieldstreet launched in 2015 with a bold yet familiar promise: to “democratize” access to private markets, even leaning on the tagline “invest like the 1%.”

But behind the marketing, the investment results were dismal. A CNBC review of 30 Yieldstreet deals found that 4 had already been written down to zero, while another 23 were on a watchlist, signalling distress. In total, those investments represented about $370 million of capital, with roughly $78 million already in default.

Rather than demonstrating accountability, the firm pointed to a tough real estate backdrop and higher interest rates. At the same time, its behaviour hardly screamed transparency. Investor letters were kept confidential, limiting information sharing across investors, and in 2023 even basic updates started arriving late. All of this came on top of very rich fees. CNBC’s analysis showed that all-in costs often ran between 3.3% and 6.7% per year.

All told, CNBC has tabulated the investment losses at just over $200 million ... so far.

Now the company has rebranded as “Willow Wealth,” with key historical performance data deleted from its website. To top it off, Willow Wealth is already out pushing a new video campaign fronted by a mascot named “Hampton Dumpty”, a character that feels on the nose given what has happened to its investments. And in a move that should surprise no one, comments for the video below are disabled.

Conclusion: Selectivity is Key

Private markets shouldn’t be painted with a broad brush. The gap between the best and worst performers remains sizeable, and much wider than in public markets, where pricing transparency and liquidity tend to compress outcomes. This unevenness makes manager selection absolutely critical. A well-chosen private markets manager can be a long-term source of outperformance, while a poor choice can erode value for years.

For this very reason, investors should study the weaker players and failed funds, not only to avoid repeating their mistakes but to understand what structural or behavioural factors led to underperformance. In a market where access and quality vary so dramatically, learning from both the highs and the lows is essential.

Want to find out more?

Private markets are not for everyone, and come with a number of risks, such as higher illiquidity and less transparency.

However, many of the world’s leading institutions and wealthiest families put a big emphasis on private markets, and recently these strategies have become more available to individuals too. Drawing on my background as an analyst specializing in private markets, I help investors cut through the complexity and understand how to build portfolios incorporating these strategies.

To explore whether these strategies are suitable for you, please schedule a 30-minute virtual meeting below: