The G Word

One of the most common (and most reasonable) questions investors ask about private markets funds is, “What happens if I want my money back?”. The honest answer is: "it depends".

Evergreen private market funds generally offer quarterly liquidity; investors can request redemptions up to four times per year. But this flexibility is limited because withdrawals often depend on available cash, fund structure, and market conditions. This brings us to the G word: Gating.

A Necessary Evil, and Quite Common Too

In a traditional mutual fund that holds publicly traded stocks, redemptions are relatively straightforward: when investors want their money back, the fund can sell some of its holdings, raise cash, and return it to investors.

In funds that hold illiquid assets, however, it’s not that simple. If too many investors request redemptions at once, the manager may be forced to sell assets at unattractive prices. This erodes the fund’s value and penalizes investors who remain invested. Gating provisions exist to avoid exactly this scenario.

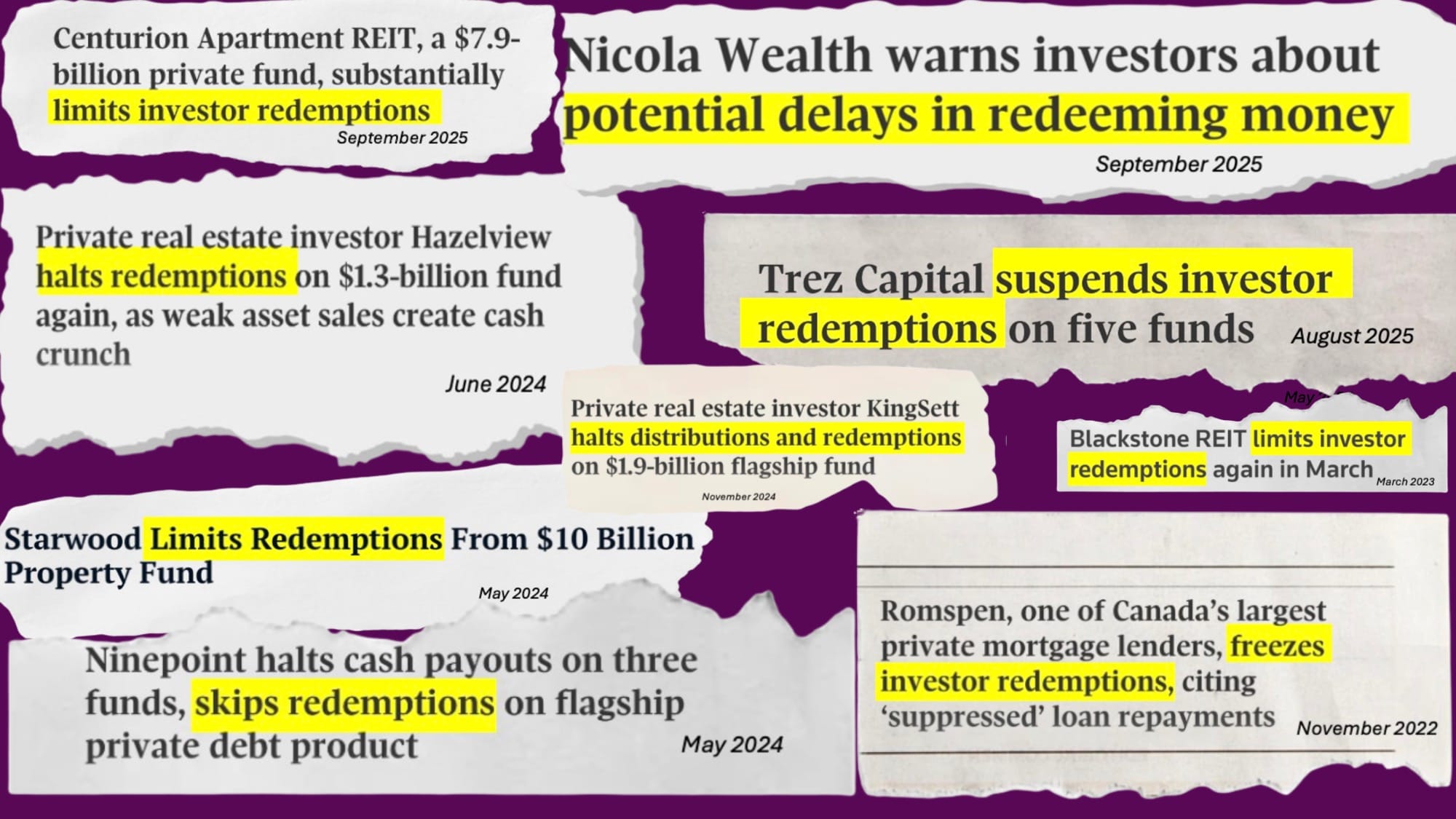

This isn’t just a theoretical exercise. In recent years, several funds (especially in real estate) have gated as rising rates and slower deal activity strained liquidity.

A Liquidity Checklist

While gating is still better than the alternative, there are still a number of related factors investors should consider before investing in a private markets fund:

1. The Terms

When evaluating an evergreen fund, one of the first things to assess is whether its liquidity terms reasonably reflect the liquidity of its underlying investments. In other words, the more illiquid the assets, the stricter those terms should be.

Most evergreen funds cap total redemptions at about 5% of total fund value per quarter. If aggregate redemption requests exceed that limit, investors would be told to get in line (as seen in the newspaper clippings above). Even this 5% threshold can be suspended at the manager’s discretion, if market conditions make it difficult to sell assets without impairing value. Many funds also apply a “soft lock” period, imposing a small penalty on investors who redeem shortly after investing (e.g. within the first year).

While these features might feel restrictive to those used to mutual funds, they exist to protect all investors, and excessive liquidity promises should be viewed as a red flag.

2. The Portfolio

When selecting an evergreen fund, it’s critical to focus on the structure of the portfolio. For starters, the fund should be adequately diversified while maintaining enough liquid assets to meet its redemption terms. Evergreen funds that invest in other funds require extra attention since underlying commitments can tie up capital and create hidden liquidity pressures.

In a related matter, it's critical that the portfolio is valued properly. While it’s always wise to avoid overpaying for assets, fair and transparent valuations take on heightened importance in private markets funds offering periodic liquidity. If a fund’s holdings are marked too high, investors may rush to redeem before inevitable valuation adjustments, triggering large-scale withdrawals that strain liquidity.