Quick Thought: What Exactly are KKR and Apollo Drinking?

On Monday last week, Keurig Dr Pepper (KDP) announced a $7 billion investment led by KKR and Apollo, but this was not a cookie-cutter deal. On the contrary, the transaction stands out because it showcases how private markets can offer flexible capital solutions that traditional banks and public markets cannot provide. Rather than a simple equity or debt issuance, this was a customized financing structure designed to meet a specific need for KDP and its shareholders.

Keurig Dr Pepper's Dilemma:

KDP was in an awkward position. After years of struggling coffee segment performance since its acquisition of Keurig Green Mountain in 2018, the company announced an $18 billion acquisition of coffee giant JDE Peet's in August. This move will see KDP split into two separate companies: a coffee business combining JDE Peet’s with Keurig, and a beverage unit anchored by brands like Dr Pepper and 7UP. While management sounds confident in the plan, investors are skeptical. The stock declined by 11% following the deal announcement, and has sunk by ~30% in the past 3 years.

Worse still, the JDE Peet acquisition was set to increase KDP's debt to $38 billion, and rating agencies were considering cutting KDP's rating to junk status. Management was determined to retain an investment grade rating for both companies post-split, but raising equity would be expensive with the share price languishing. Enter Apollo and KKR.

The Solution: A Deal With a Few Moving Parts

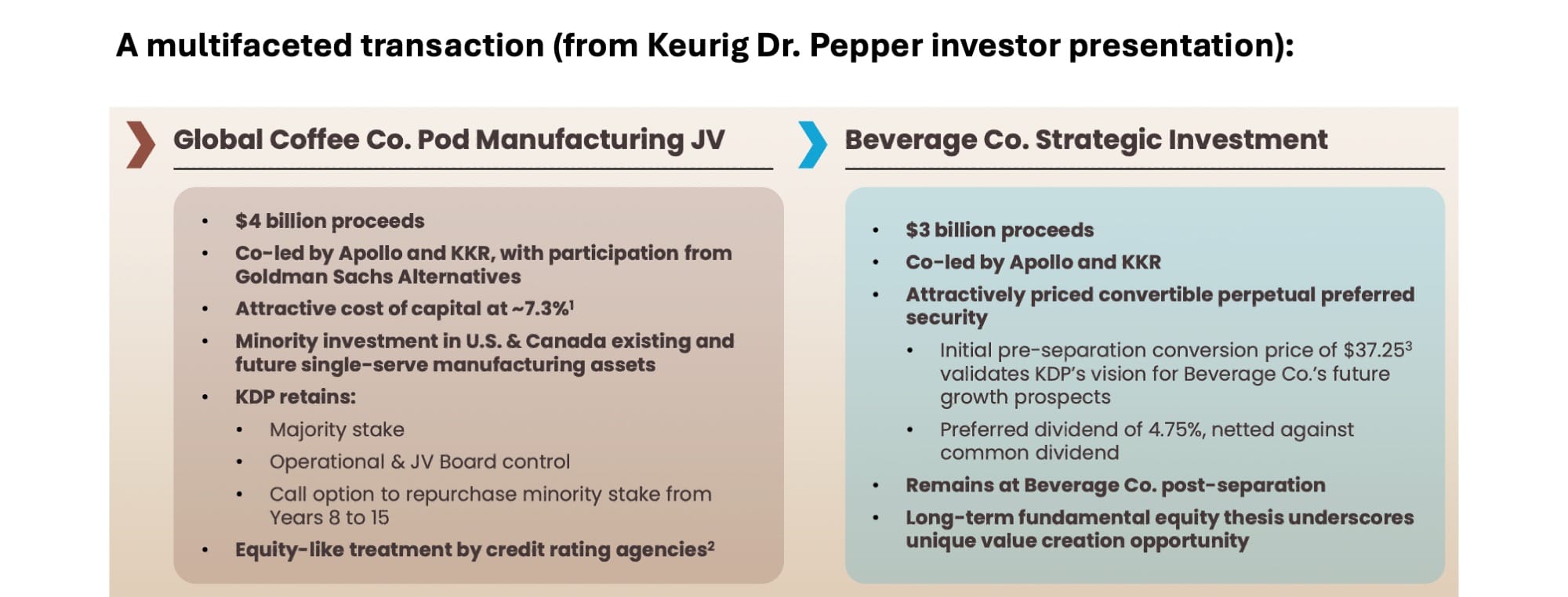

The deal is divided into two parts. The first part will see Apollo and KKR (along with Goldman Sachs) investing a combined $4 billion in a coffee pod manufacturing joint venture. The two firms will also make a $3 billion investment in convertible preferred stock in KDP's beverage unit.

There are several reasons this transaction serves as a compelling case study. The deal’s complex structure makes a competitive bidding process unlikely, and it’s difficult to envision Keurig Dr Pepper securing similar terms through a traditional bank or the public markets. KDP was also negotiating under clear constraints, seeking to preserve investment-grade credit ratings for both entities following the separation. Finally, the large investment size naturally narrows the field of potential counterparties.

A Deal Tailor-Made for Private Investors

Without speculating on the outcome, this transaction already illustrates the kind of opportunity well suited to private markets. It challenges the perception that private investments are merely driven by bidding wars and cost of capital. In this case, a counterparty had a specific objective, and private capital provided a tailored solution to meet that need. Sometimes, it’s not about who pays the most; it’s about who shows up with the right wrench for the job.

Want to find out more?

Private markets are not for everyone, and come with a number of risks, such as higher illiquidity and less transparency.

However, many of the world’s leading institutions and wealthiest families put a big emphasis on private markets, and recently these strategies have become more available to individuals too. Drawing on my background as an analyst specializing in private markets, I help investors cut through the complexity and understand how to build portfolios incorporating these strategies.

To explore whether these strategies are suitable for you, please schedule a 30-minute virtual meeting below: