PwC 2030 Forecast: It Pays To Be In Private Markets

Traditional asset managers have spent the past decade plus on the defensive, grappling with underperformance, outflows, and fee compression. Firms that failed to adapt have watched their share prices stagnate while capital and profitability migrated elsewhere. At the same time, private markets have steadily captured a larger share of industry economics, and the managers focused on these areas have largely thrived.

According to PwC, this divergence is set to continue, with private markets projected to remain the most attractive engine of growth and profits in the industry. This reinforces the view that private markets are increasingly the place to be.

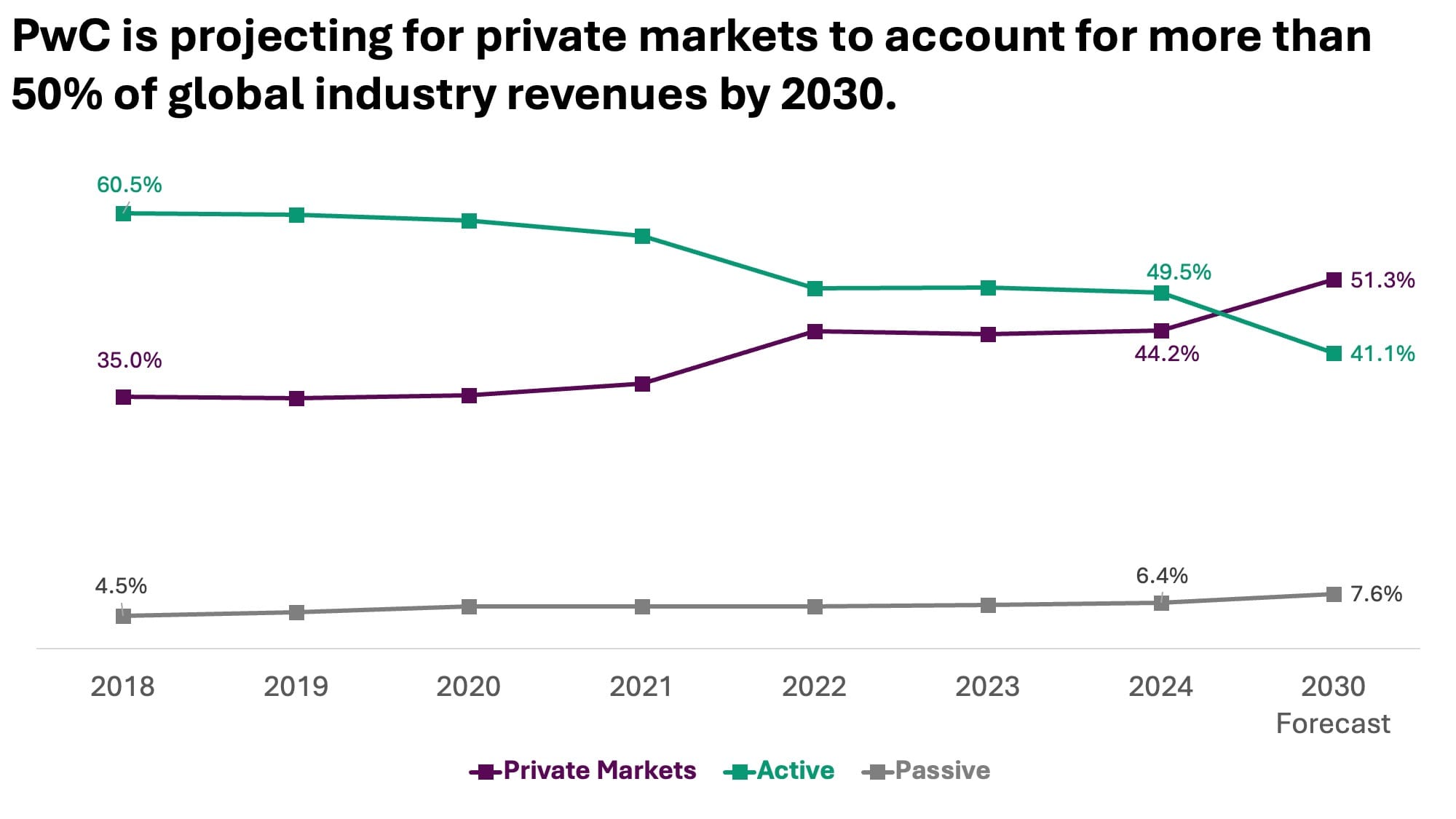

More than Half of Total Revenue By 2030

According to PwC, private markets will account for a majority of industry revenues by 2030:

This will come partly from continued share shift, with alternative investments (including private markets) forecast to grow by 58% compared to 43% for the overall market from 2024 to 2030. But PwC expects private markets to still only account for 13% of global assets under management at that time.

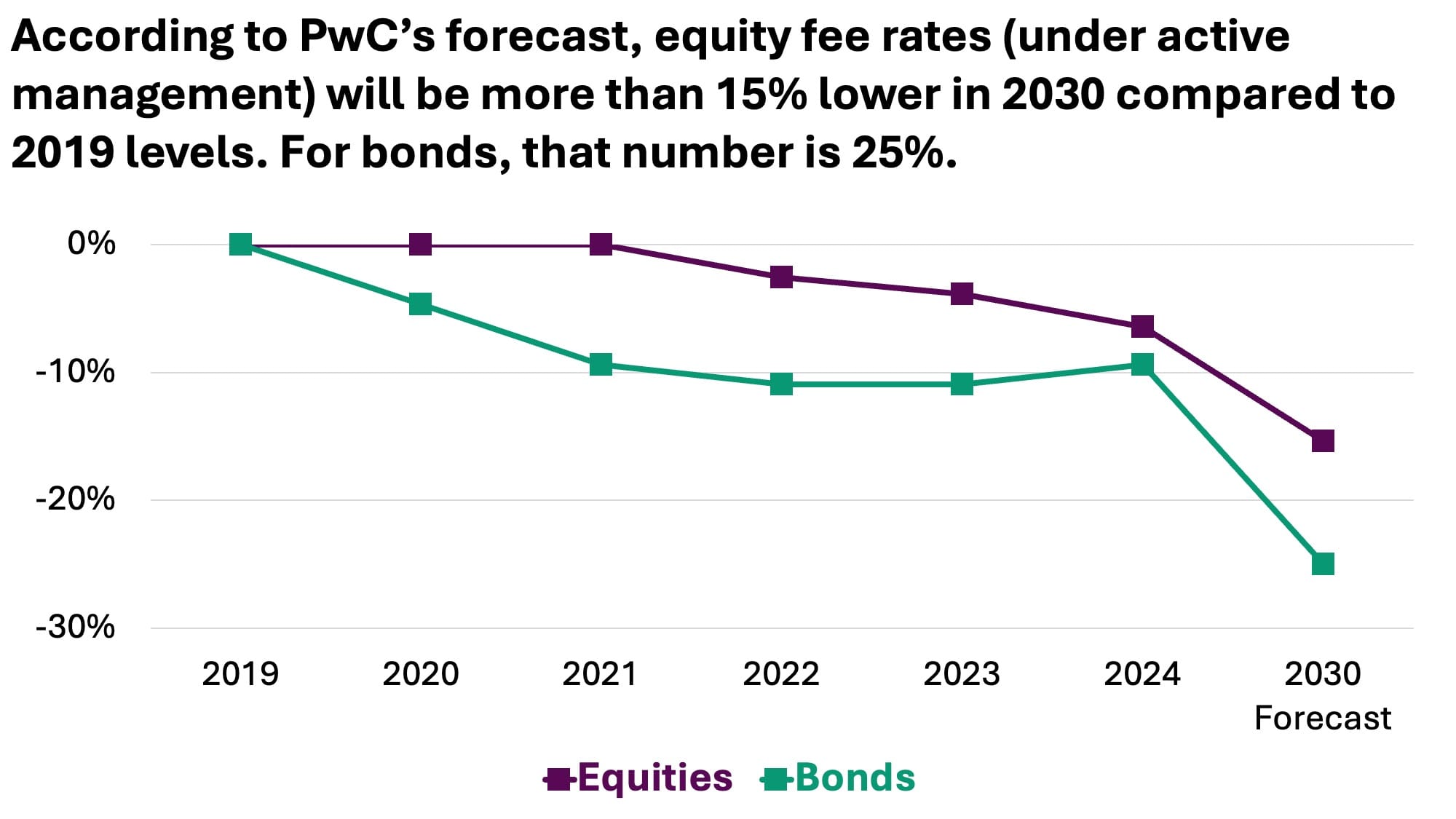

The other part of the equation is fee compression in traditional asset management. According to the report, fee rates for active equity management will be 15% lower in 2030 compared to 2019. For fixed income, that number is 25%.

A Natural Occurrence

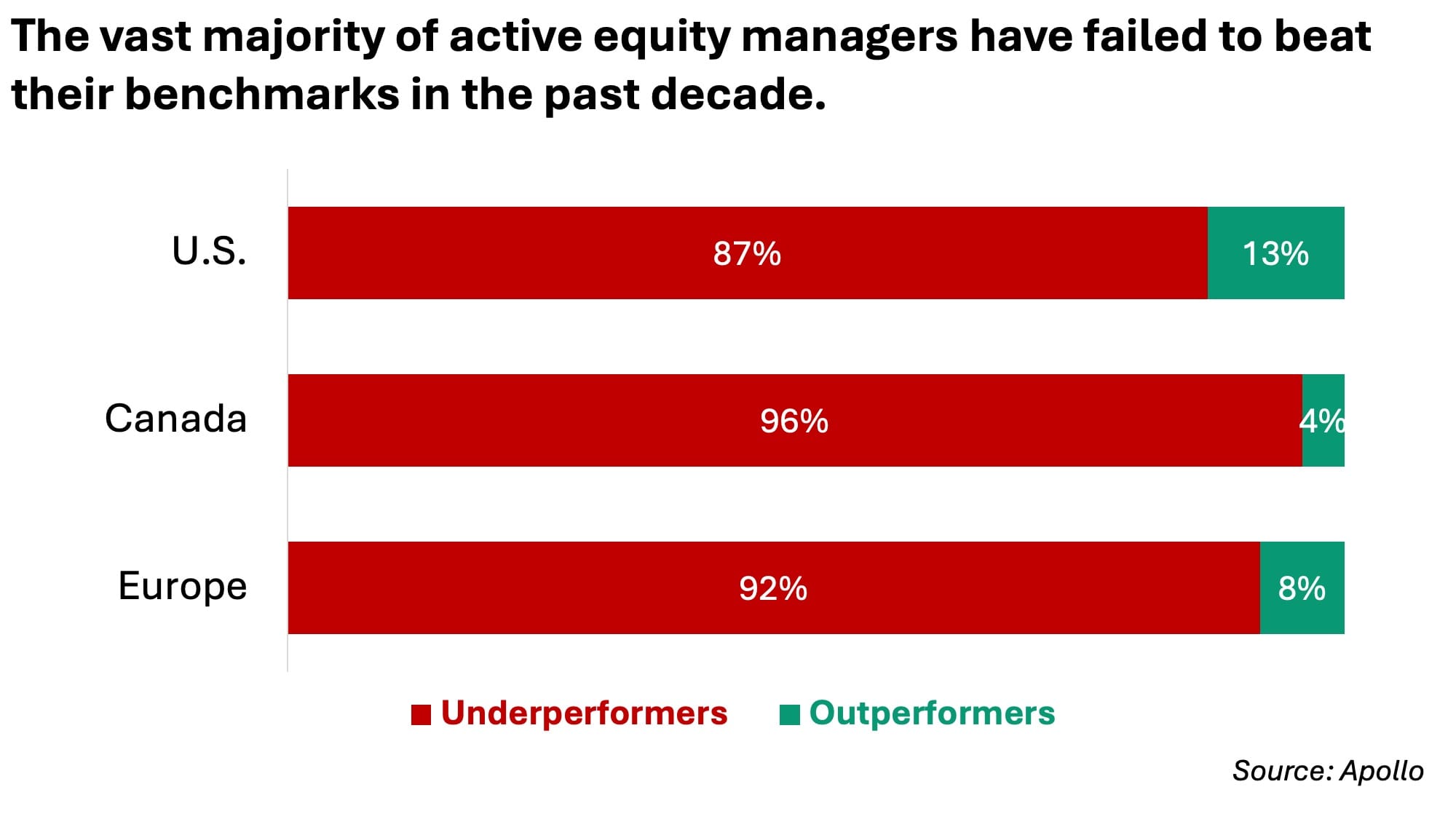

In many ways, this is to be expected. Over the past 10+ years, consistently outperforming public market benchmarks has become increasingly difficult, and the majority of active managers have fallen short.

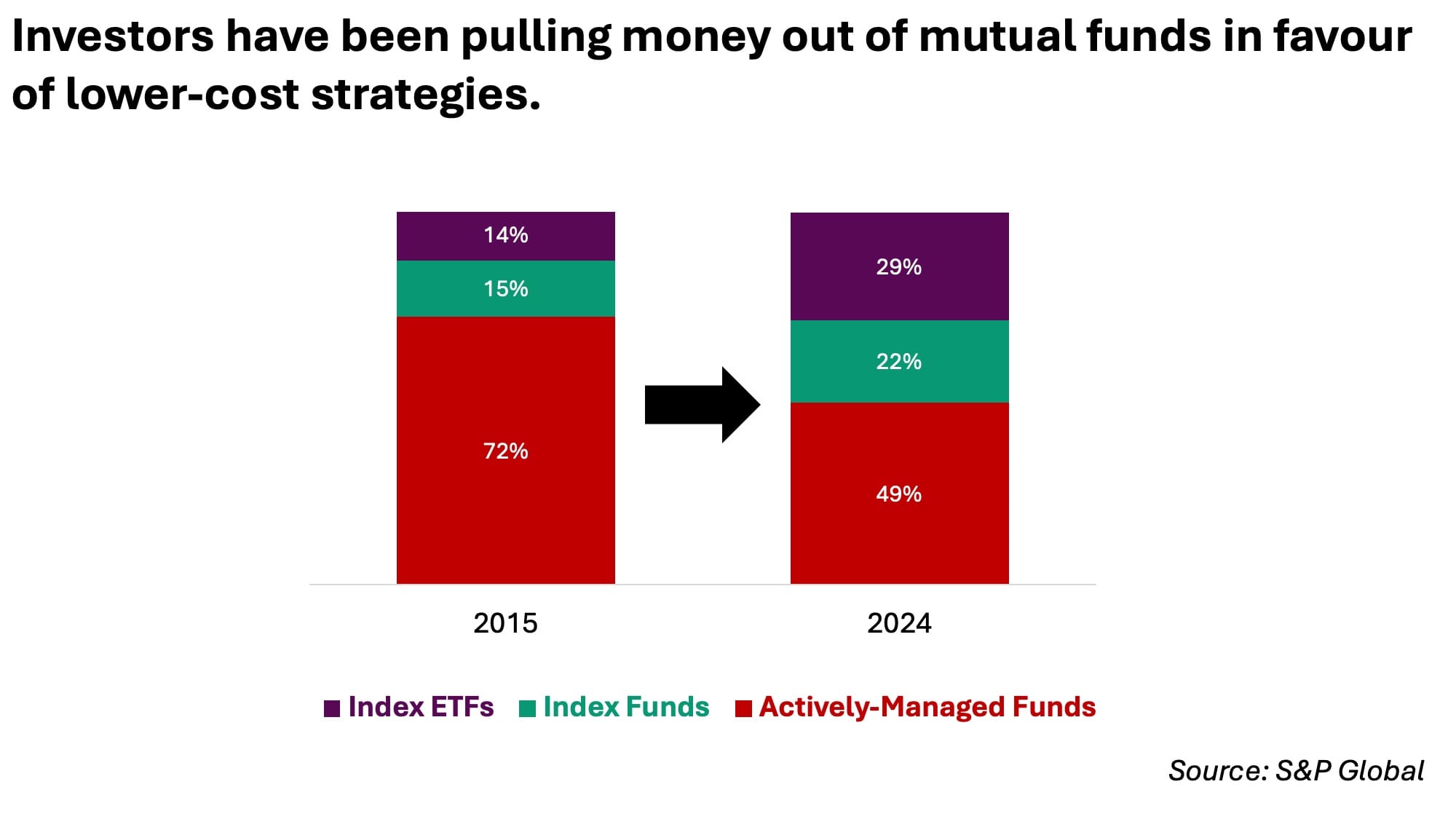

As investors have recognized this, capital has steadily migrated out of traditional active mutual funds and into low-cost funds that simply track the market. In highly efficient public markets, many investors now see little justification for paying high active fees when inexpensive passive exposure delivers similar or better outcomes. As a result, “buying the market” through the cheapest available vehicle has become the default choice for many, and in most cases that is a perfectly rational decision.