In the Gold Rush for AI, Someone Has to Sell the Picks and Shovels

“Our AI ambitions will be realized through our ability to deliver the infrastructure to support it. Our partnership with Blue Owl Capital to develop the Hyperion Data Center is a bold step forward — combining Meta’s deep expertise in building and operating world-class data centers with Blue Owl’s strength in infrastructure investment.”

Those were the words of Meta CFO Susan Li, while announcing a $27 billion hyperscale data centre project with Blue Owl in Louisiana last week. The move reflects a broader shift in private markets as alternative asset managers zero in on data centres as a core growth engine.

Firms like Apollo, Ares, and Brookfield have all identified data infrastructure as a top investment theme. Blackrock is leading a consortium of investors buying Aligned Data Centers for $40 billion. Back in 2021, both Blackstone and KKR announced major data centre purchases, QTS and CyrusOne respectively. Blackstone even launched a television campaign calling data centres and their supporting infrastructure the “picks and shovels” of the AI boom.

So this leaves a very important question: why are private markets in particular so well suited to fund the backbone of the AI economy?

The Scale of the Opportunity

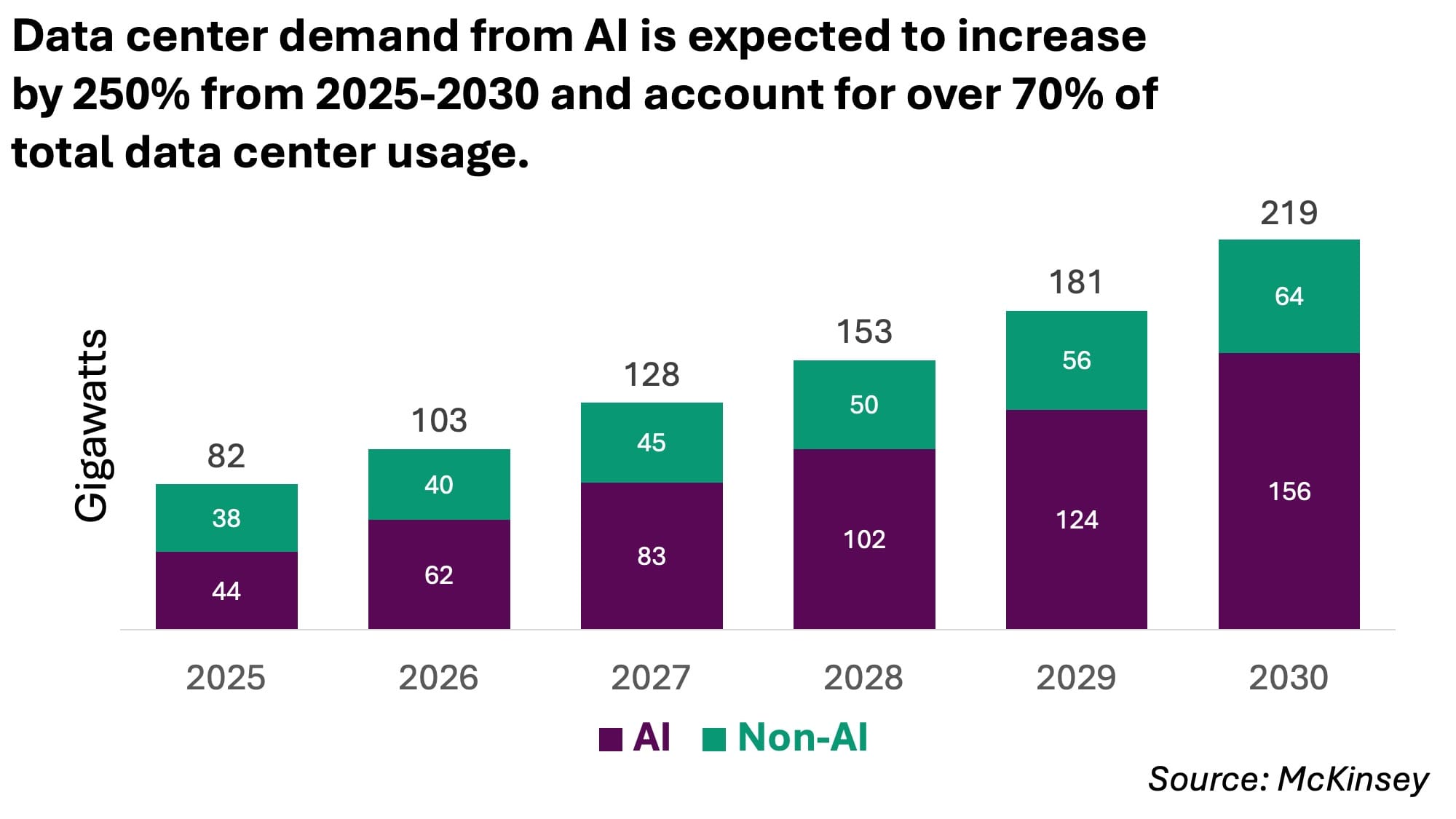

Meeting the demands of artificial intelligence is an immense challenge, as detailed in a McKinsey report released earlier this year. According to the report, AI is projected to account for over 150 gigawatts of data centre capacity by 2030, which is about equal to all of Canada's power production.

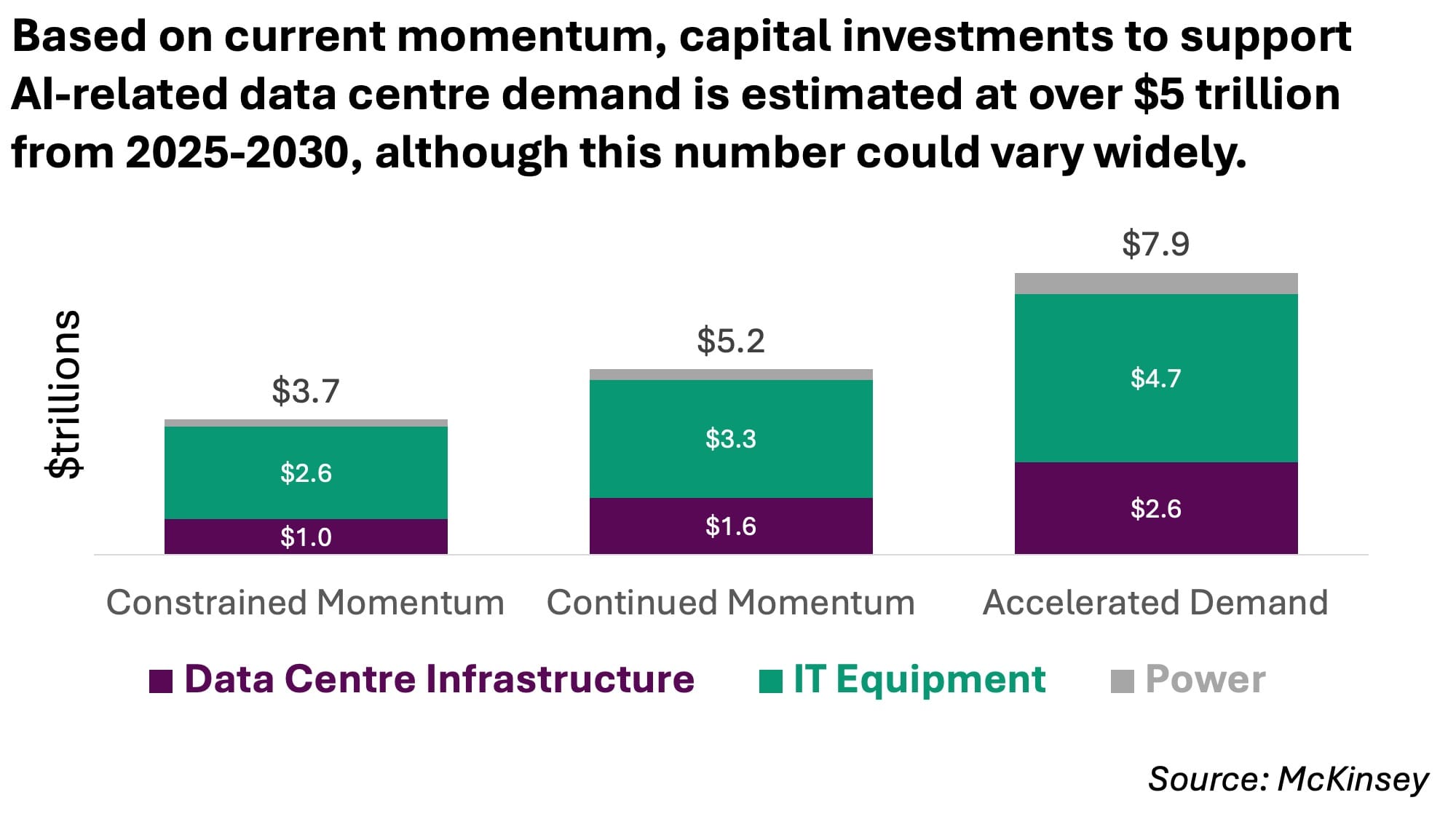

The dollar cost of this growth is staggering. According to McKinsey, meeting global AI demand will require over $5.2 trillion in capital investment for new data centres between 2025 and 2030, assuming momentum continues at today’s pace.

The Edge Private Markets Have Over Other Funding Sources

While most investors recognize the sheer size of the opportunity, it’s less obvious why private markets are uniquely suited to take advantage of it. Below we look at the main alternatives and the reasons why their limitations leave private markets in a very strong position.

1. The Hyperscalers

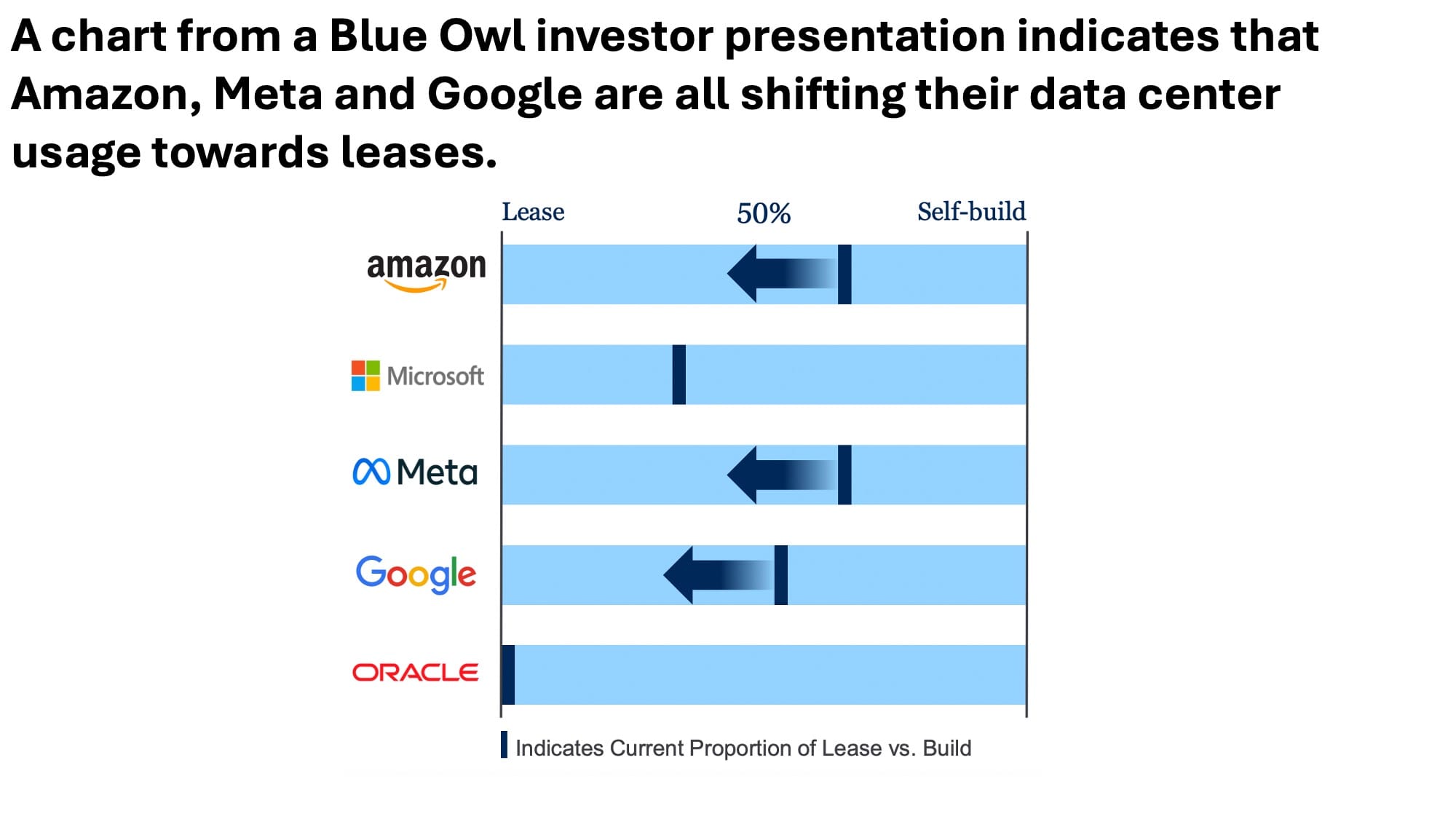

According to an Apollo estimate, approximately 90% of data centre growth will come from five firms: Microsoft, Amazon, Google, Meta, and Oracle. Together, these giants are investing $328 billion in capital expenditures for data centres in 2025, more than doubling their $140 billion spend in 2023. Yet despite this rapid increase, it’s clear (just from looking at the numbers from the above chart) these companies cannot shoulder the entire burden alone.

Moreover, Morgan Stanley estimates that these firms can only fund about half of their capital expenditure from cash flow, and investors are unlikely to support large equity or debt raises. As a result, many are shifting towards a leasing strategy. Oracle is already leasing 100% of its data centre capacity, citing greater agility and capital efficiency. However, this means the upfront investment must come from other sources.