In (Mostly) Defence of Blue Owl

Blue Owl has had a rough year.

In the private credit space, investors have become concerned with sluggish deal flow, margin pressure from falling rates, and mounting competition from rival direct lenders. Then this month, things went from bad to worse.

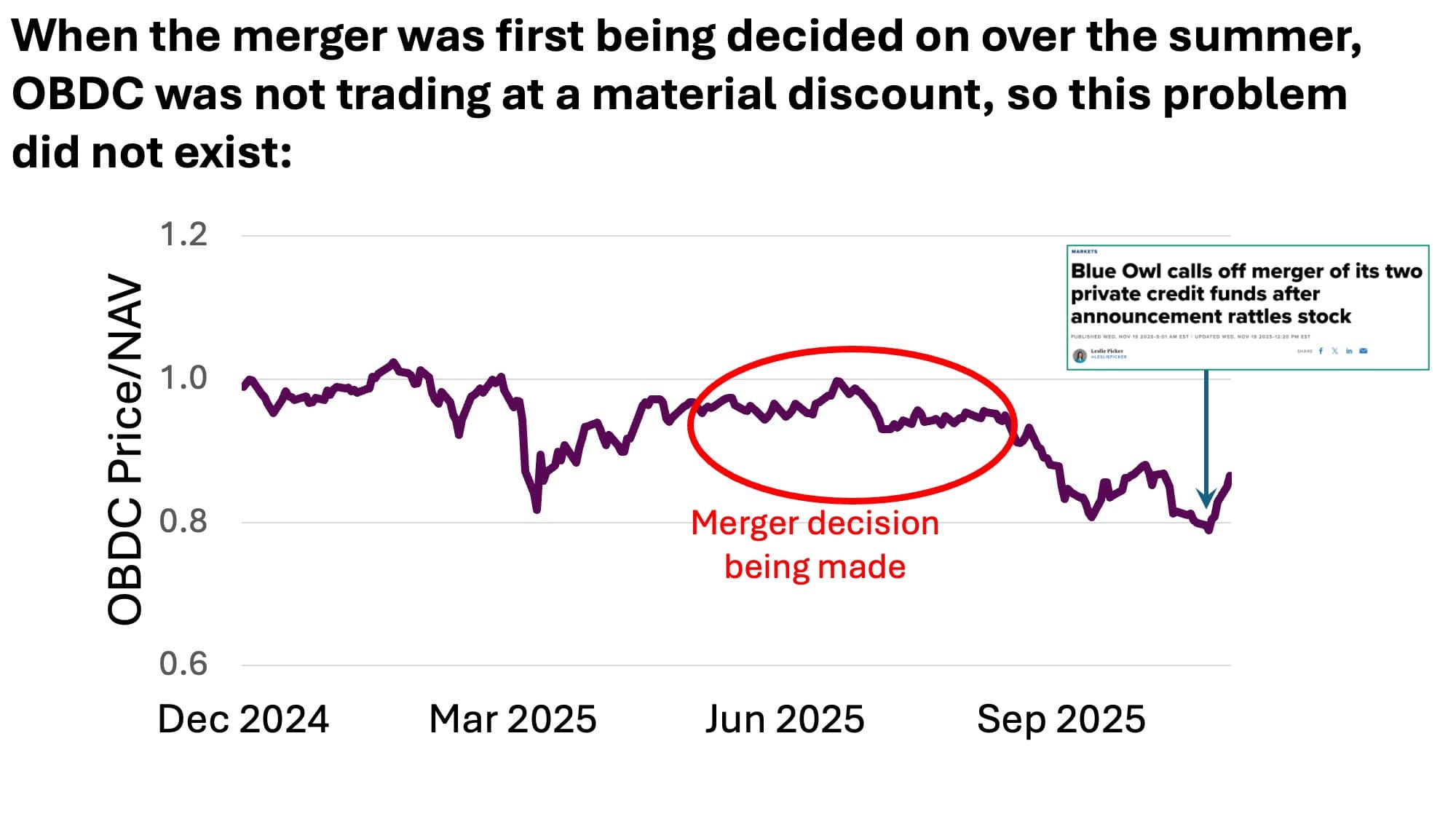

In early November, Blue Owl announced a move it didn’t expect to be controversial: merging its smaller private credit fund, OBDC II, into the larger private credit fund OBDC I. But two major issues quickly surfaced. First, OBDC I traded at a 14% discount to its net asset value, meaning OBDC II unitholders would effectively take a 14% haircut if the merger went through.

Second, the merger would have temporarily suspended redemptions for OBDC II investors. In an environment already wary of illiquidity in private markets, that restriction was interpreted as a red flag.

The backlash was swift. Blue Owl’s stock fell 6% as the story broke, and the company reversed the decision two days thereafter amid the growing media storm. Despite a slight recovery over the past few days, the stock is down by nearly 40% year-to-date.

So how should we interpret this? Was it simply a media overreaction, as Blue Owl claims? Or is this company the canary owl in the coal mine?

Two Sides to the Story

To be clear, this is not a great look. Blue Owl effectively proposed that private credit investors accept a 14% haircut by merging into a vehicle whose public shares trade at a discount. More concerning, this saga highlights the valuation risk of these private credit offerings, since public market investors are signalling that Blue Owl’s underlying assets may be worth less than what the firm reports privately. That dynamic raises difficult questions about future fundraising, or even capital retention, if private investors can access the same exposures in the public market at a steep discount.

Still, much of the nuance was lost in the reaction from media and investors, including:

- When the merger was first contemplated in the summer, the 14% discount did not exist; OBDC I was trading close to par.

- Blue Owl was not attempting to force a merger on anyone; as conditions worsened, management still felt compelled to offer unitholders a vote, and let them decide.

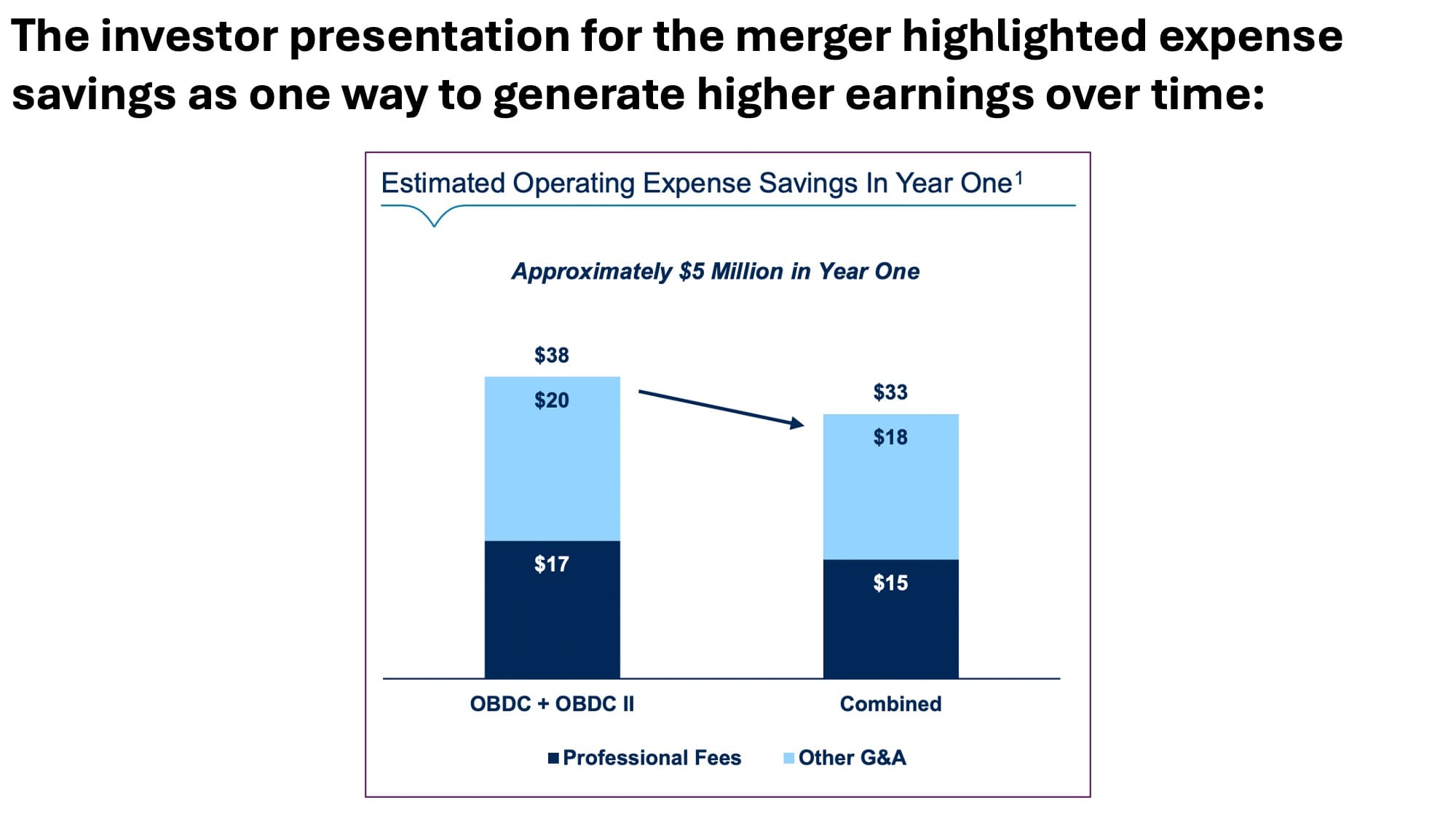

- OBDC II shareholders may have taken a short-term hit to net asset value through a merger, but there would have been a potential benefit to earnings.

- The restriction on redemptions is standard practice when merging two such funds, since handling redemptions during the process is operationally prohibitive.

- Blue Owl is under no pressure to find another solution and can afford to wait for a better time to attempt this type of transaction again.

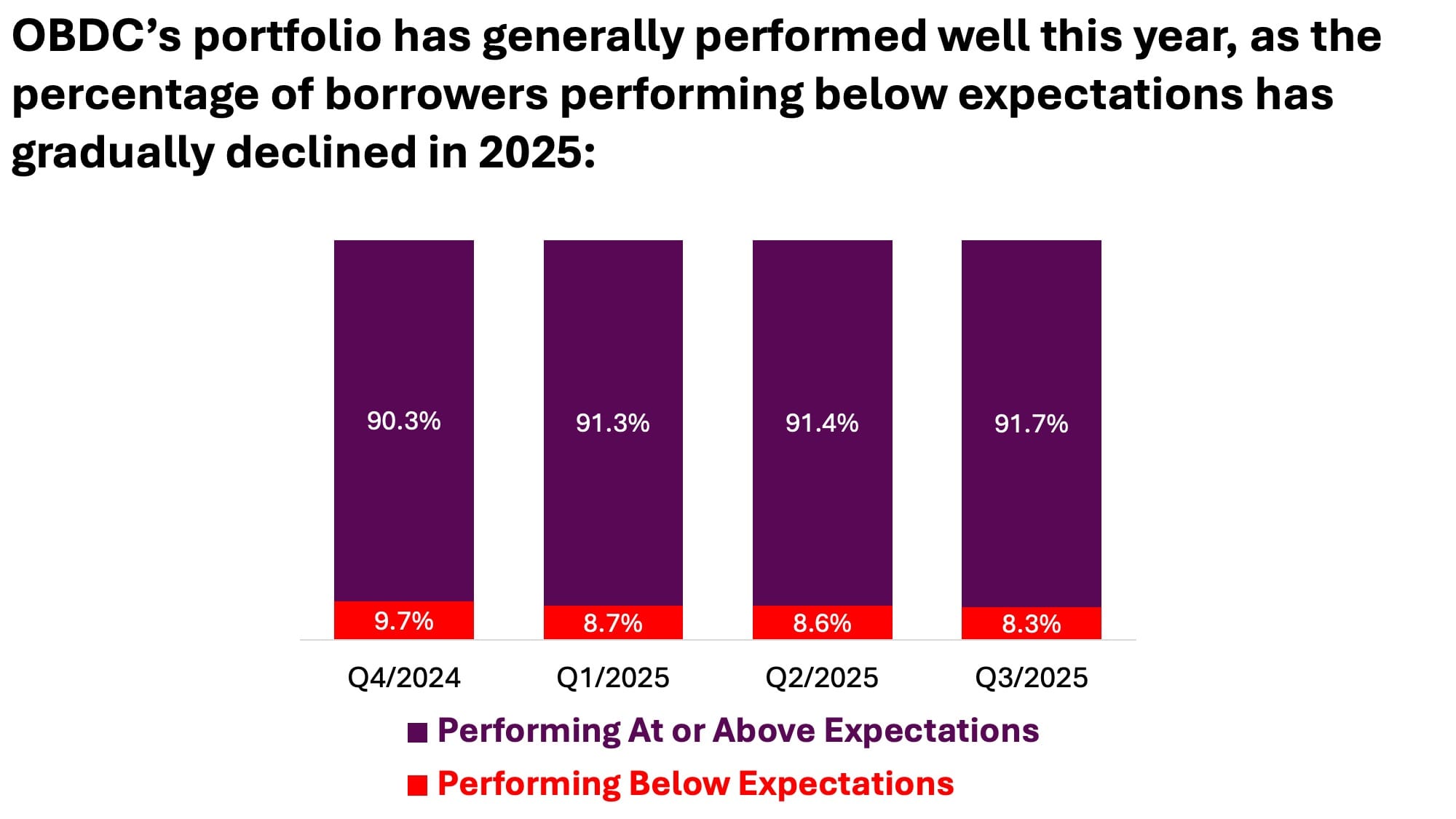

- Blue Owl’s private credit funds have been performing as intended in 2025, as borrower health has gradually improved.