How Evergreen Funds Are Redefining Private Market Investing

Imagine writing a $50 million cheque to buy into an investment fund, only to watch it gather dust, and not knowing when the money will be put to work. That’s the reality for investors in traditional private markets funds: they pledge large sums, but the actual deployment of their capital is a waiting game, dictated entirely by the fund manager’s unpredictable calls. Meanwhile their money sits idle, yet must remain ready at a moment’s notice. And then after the money is invested, and the time comes to get that money back? Again it’s the manager’s call, leaving investors in the dark about when they’ll see their returns.

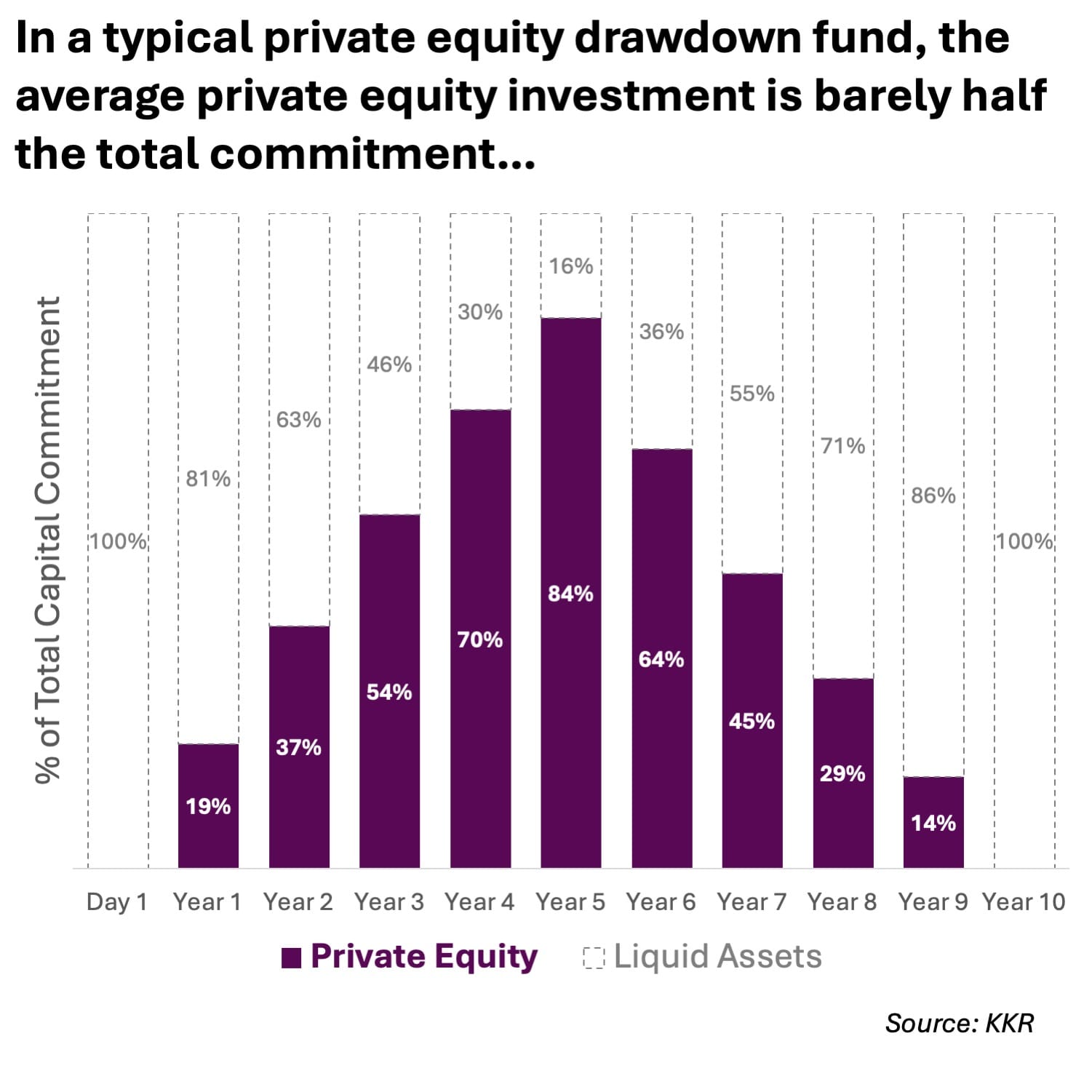

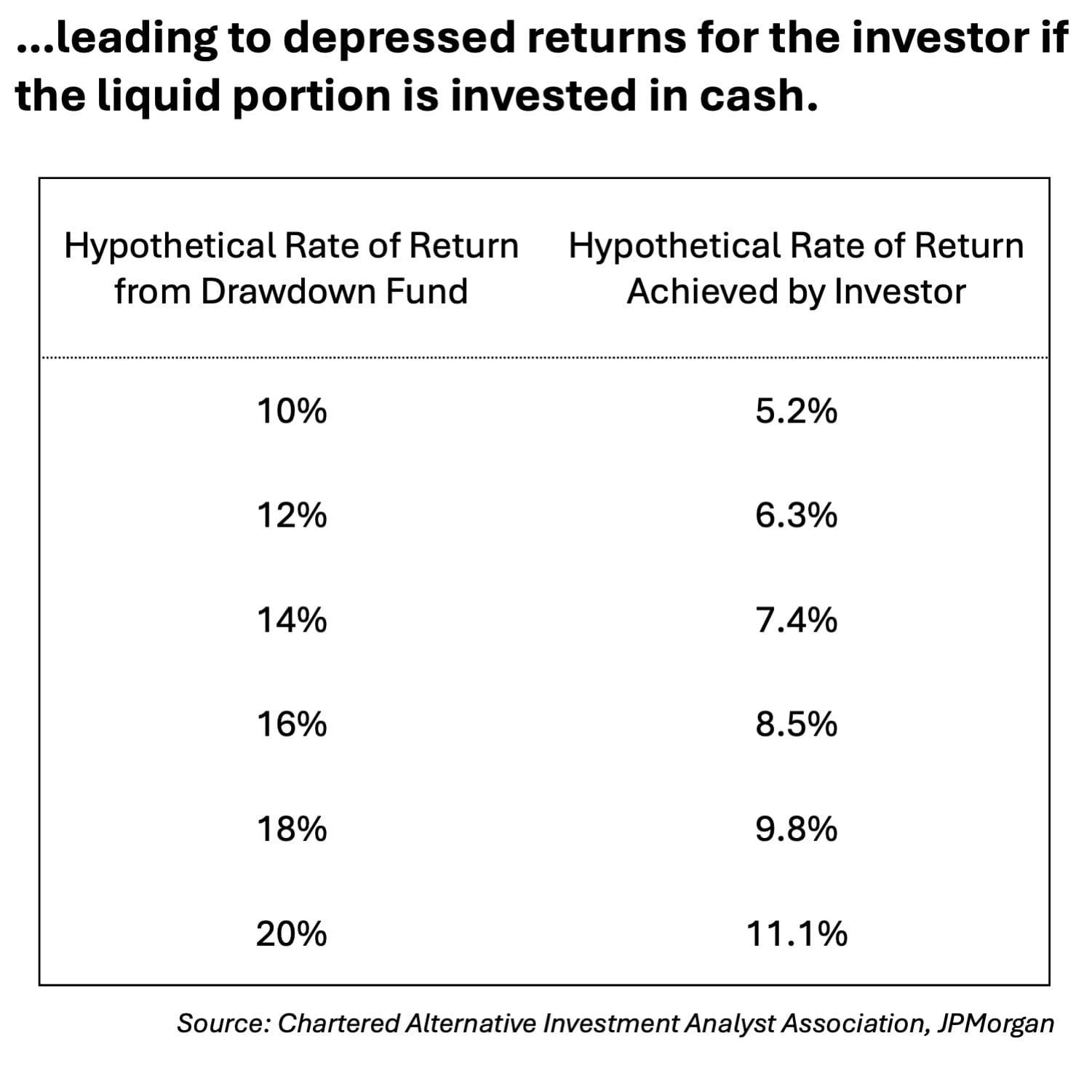

This traditional “drawdown” fund structure often results in the investor’s deployed capital being significantly less than their total commitment at any given time. For example, a KKR analysis estimated that the average invested amount can be barely half of the committed capital. Large investors are used to dealing with this dynamic, managing multiple funds and maintaining a (somewhat) steady allocation. On the other hand, this is a complex and cumbersome exercise for the rest of us. It can also lead to much lower returns.

Evergreen Funds: A Flexible and Investor-Friendly Alternative

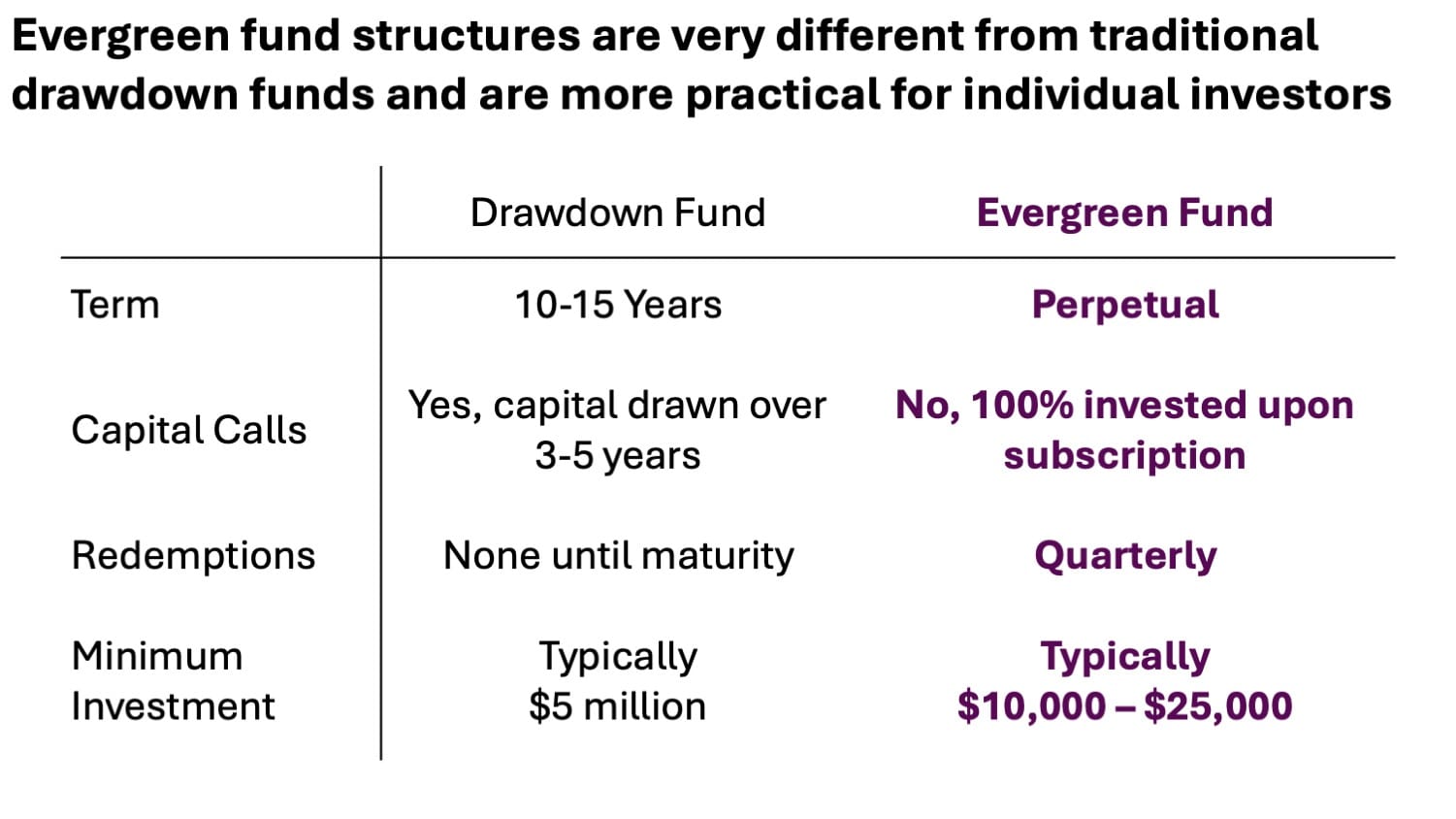

Evergreen funds are designed to address many of the frustrations investors face with traditional private markets structures. Not unlike mutual funds, evergreen funds are open-ended and continuously available, allowing investors to buy or redeem shares at regular intervals based on the fund’s net asset value. This means new investors can put their capital to work right away, without waiting for capital calls or worrying about uninvested cash sitting idle.

Another key advantage is accessibility. Evergreen funds typically require much lower minimum investments compared to traditional private markets funds, opening the door for a broader range of investors to participate.

The Challenges of Evergreen Funds

Unfortunately it's not so simple when illiquid assets are held in such a structure, and there are a number of issues that can be quite tricky to deal with:

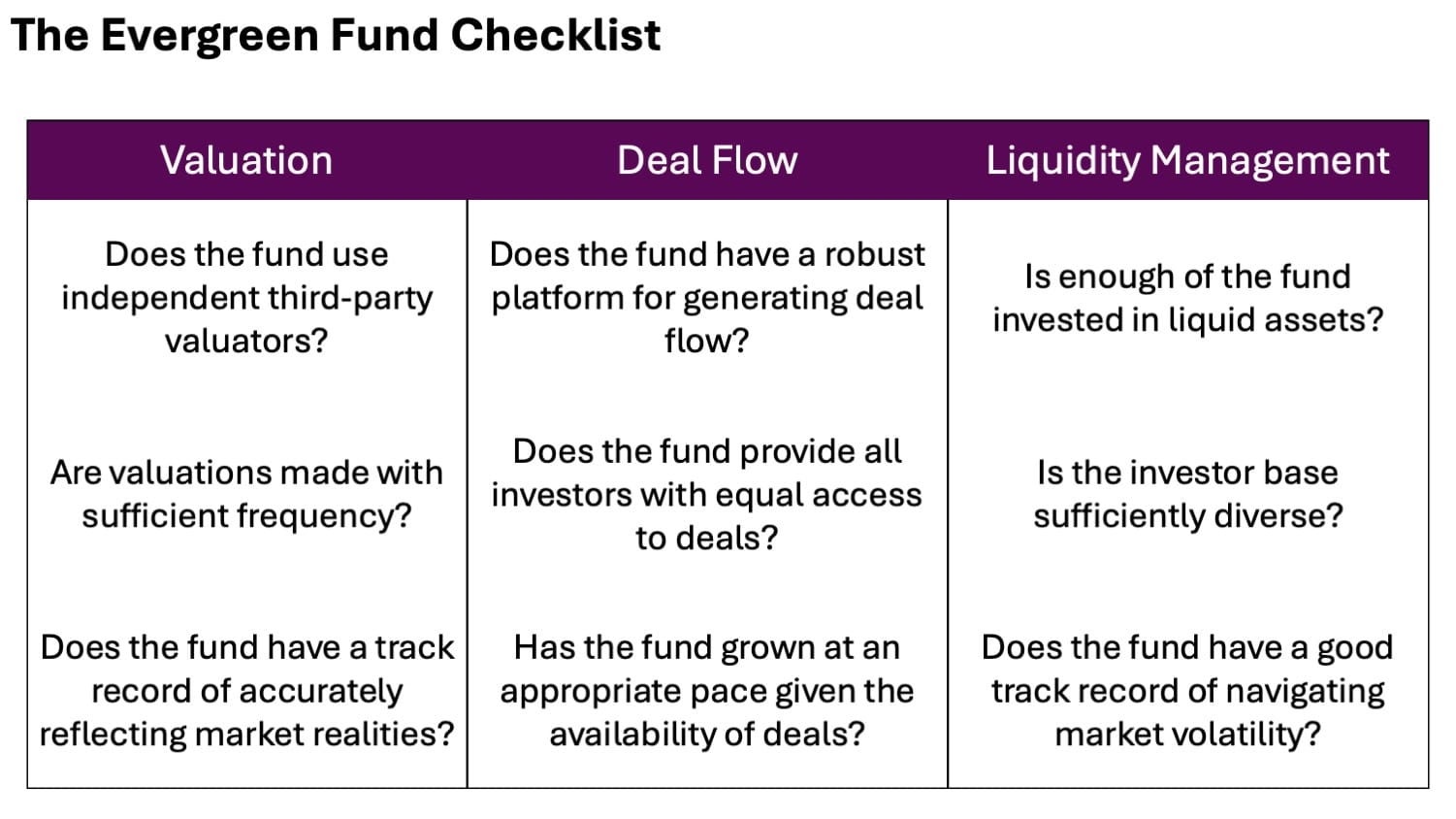

- Valuation: Unlike public securities with transparent market prices, private assets in evergreen funds lack clear, real-time valuations. This creates significant challenges in determining accurate net asset values for both new and existing investors. Robust valuation frameworks are essential, typically involving independent third-party valuation firms and frequent updates. The ability to swiftly and transparently adjust valuations in response to market events is critical. Failure to do so can create arbitrage opportunities, where investors try to time subscriptions or redemptions to their advantage, potentially harming other investors.

- Deal Flow and Deployment Discipline: Evergreen funds must deploy incoming capital as it arrives, but quality deal flow can be very choppy. When new investor money arrives faster than attractive investment opportunities, cash may sit idle, dragging on returns. Worse, the pressure to deploy capital quickly can lead to suboptimal investment decisions or a lowering of underwriting standards. To mitigate these risks, managers need a consistent pipeline of high-quality deals, clear policies on capital allocation, and a willingness to slow down fundraising when quality deals are in short supply.

- Liquidity Management: Providing periodic liquidity is a core selling point of evergreen funds, but it remains a double-edged sword. Since the underlying assets are illiquid, meeting redemption requests can sometimes be very difficult, especially during market downturns. Effective liquidity management frameworks are thus vital. These typically include maintaining a reasonable buffer of liquid assets, having appropriate redemption limits, and performing regular stress-testing. A diverse investor base is also very helpful in preventing herd behaviour and large spikes in redemption requests.

A New Frontier, With Caveats

Evergreen funds are opening doors for individual investors, offering an opportunity to participate in private markets. However this access comes with a unique set of challenges, from complex valuations and deal flow constraints to the ever-present risks of illiquidity. For those willing to do their homework and choose wisely, evergreen funds can be a powerful addition to a well-constructed portfolio. But in this corner of the investment world, selectivity and diligence are critical.

Want to find out more?

Private markets are not for everyone, and come with a number of risks, such as higher illiquidity and less transparency.

However, many of the world’s leading institutions and wealthiest families put a big emphasis on private markets, and recently these strategies have become more available to individuals too. Drawing on my background as an analyst specializing in private markets, I help investors cut through the complexity and understand how to build portfolios incorporating these strategies.

To explore whether these strategies are suitable for you, please schedule a 30-minute virtual meeting below: