BTE Newsletter #7: The Elroy Gust Interview

Hey everyone,

The podcast is officially rolling! Episode two was released yesterday, featuring Sean O’Hara from Obsiido.

Coming up next, episode three features Elroy Gust, CEO of Newlook Capital, and it’s set to go live early next week. As usual, I’ve posted part one of the interview as this week’s feature article, so check it out below.

Just a heads-up: please don’t get too used to the weekly pace. It’ll probably settle into every couple of weeks, but some great guests have come forward ... and there's no harm in releasing a few episodes in quick succession to start out.

Stay tuned for more.

Ben

📝 Posts From the Past Week

A Conversation With Elroy Gust of Newlook Capital

(Featured Post)

Published Today

Elroy Gust, CEO of Newlook Capital, joined me for a wide-ranging conversation about the origins of Newlook, how the firm operates, and what led a private equity company to launch a strategy focused on dentistry. This is part 1 of the interview.

PwC 2030 Forecast: It Pays To Be In Private Markets

Published Thursday December 4th

PricewaterhouseCoopers is forecasting for private markets to account for over half of all revenues in investment management by 2030. This brings up two questions: how and why?

🗞️ 3 Stories to Watch From the Past Week

StepStone Group: Not All Evergreens are Created Equal (Private Equity International)

Monday December 1st

In an interview with Private Equity International, Neil Menard and Miguel Sosa of Stepstone talk about the evolution of private markets for individual investors, the role of evergreen funds, and what challenges asset managers face as they navigate this landscape. As put by Mr. Sosa, managing an evergreen vehicle "isn’t simply a case of putting private markets strategies into an evergreen fund, offering a window of liquidity and walking away."

Michael Sidgmore: Private Markets Firms Need to Go Big or Go Niche (EQT)

Wednesday December 3rd

In a guest opinion column for Swedish private equity giant EQT, Michael Sidgmore argues that asset managers "need to figure out who they are and what they want to be" as they grapple with today's challenges. This could mean using scale as an advantage, especially if a firm wants to pursue individual investors, a topic I covered in a previous article. But Mr. Sidgmore also argues that $5-10 billion managers can still thrive, as long as they are "unique" in some way. In any case, the environment is less friendly towards lower-tier players than in years past, forcing many firms to make some tough decisions.

Capital Group and KKR to Advance Strategic Partnership, with Innovation Across Retirement Solutions and Model Portfolios (Press Release)

Wednesday December 3rd

This announcement builds on an existing partnership between one of the world's largest mutual fund managers (Capital Group) and one of the world's largest alternative asset managers (KKR), to create products that hold a mix of public and private assets. In many ways this is the final frontier for private markets, since these vehicles are created for mass market investors who still benefit from (or need) daily liquidity. The two companies have already launched two credit-focused vehicles, with an equity-focused vehicle slated to launch in early 2026.

💬 Quote of the Week

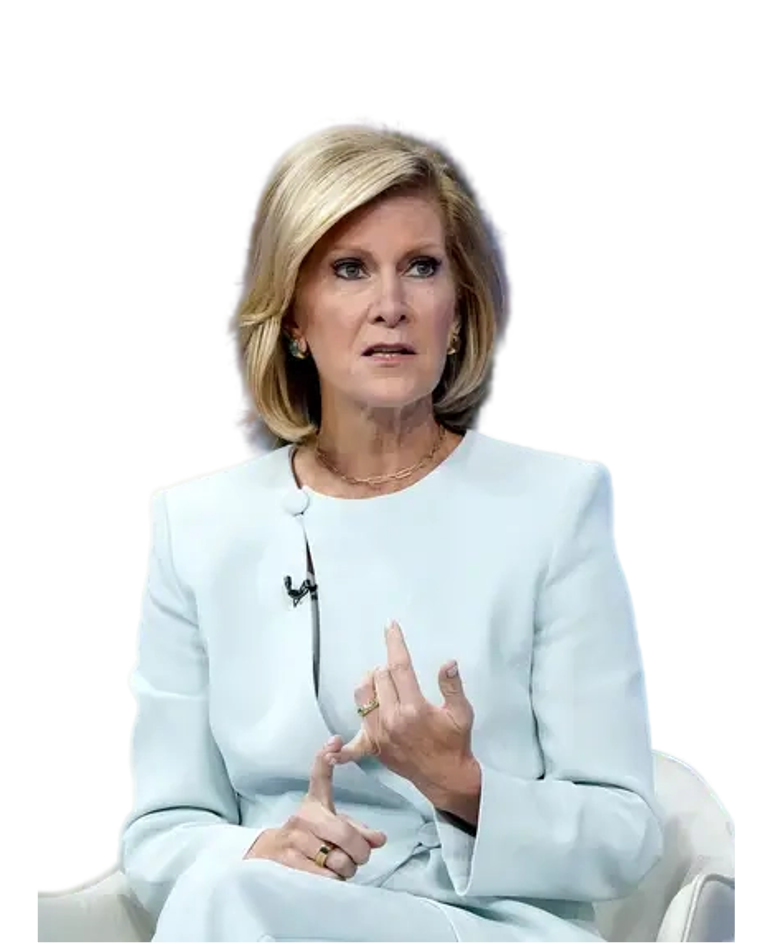

"There should just be no such thing as a public markets portfolio for almost anyone in the world, if you can risk manage it ... it should be a public to private continuum. That's how you should think about it."

Mary Erodes, CEO of JPMorgan's Asset & Wealth Management business, speaking at the CNBC Delivering Alpha conference.

Want to find out more?

Private markets are not for everyone, and come with a number of risks, such as higher illiquidity and less transparency.

However, many of the world’s leading institutions and wealthiest families put a big emphasis on private markets, and recently these strategies have become more available to individuals too. Drawing on my background as an analyst specializing in private markets, I help investors cut through the complexity and understand how to build portfolios incorporating these strategies.

To explore whether these strategies are suitable for you, please schedule a 30-minute virtual meeting below:

Disclaimer

Benjamin Sinclair is a representative of Designed Securities Ltd. Designed Securities Ltd. is regulated by the Canadian Investment Regulatory Organization (ciro.ca) and is a Member of the Canadian Investor Protection Fund (cipf.ca). Investment products are provided by Designed Securities Ltd. and include, but are not limited to, mutual funds, stocks, and bonds. Benjamin Sinclair is registered to provide advice and solutions to clients residing in the province of Ontario. For more information, please see www.beyondtheexchange.ca/disclaimer/