BTE Newsletter #11: Sports!

Hello again everyone, and I hope your year is off to a good start.

For my part, I just recorded episode #5 of the BTE podcast (see more below), and also now have the next two scheduled as well. It's safe to say I'm thrilled with the caliber of guest that's been willing to appear, so a big thank you to all who've done so. And if you (or someone you know) would like to be a guest, please let me know.

I've also gotten some good early feedback on my 2026 outlook (if you're subscribed to the newsletter, you can find a download link to the outlook on the welcome page here).

Regarding the format of this newsletter, I will likely centre it around one big thought piece from now on, starting with the one below on private markets' role in sports. This comes after KKR reportedly acquired a large sports investor ... and after the NFL playoffs begun (without my team in it).

Ben

Why Are Private Markets' Firms So Excited By Sports?

Just last week, Bloomberg reported that KKR is acquiring sports investing specialist Arctos at a $1 billion valuation. This follows major announcements from the likes of Apollo and CVC last year, and one should expect a lot more in the years ahead.

“When you look at what sports assets do relative to other things you own, completely non-correlated outcomes relative to a traditional 60-40 portfolio, and have compounded at close to 15% rate of return for the last 15 years. But five years ago, uninvestable.”

- Michael Arougheti, CEO, Ares Management

For decades, the business of sports barely evolved. Throughout most of the 20th century, team revenues relied almost entirely on ticketing, concessions, and local advertising. While the revenue model slowly modernized thereafter, ownership structures took a lot longer; institutional capital was barred from owning stakes in all major U.S. professional leagues until as recently as 2019.

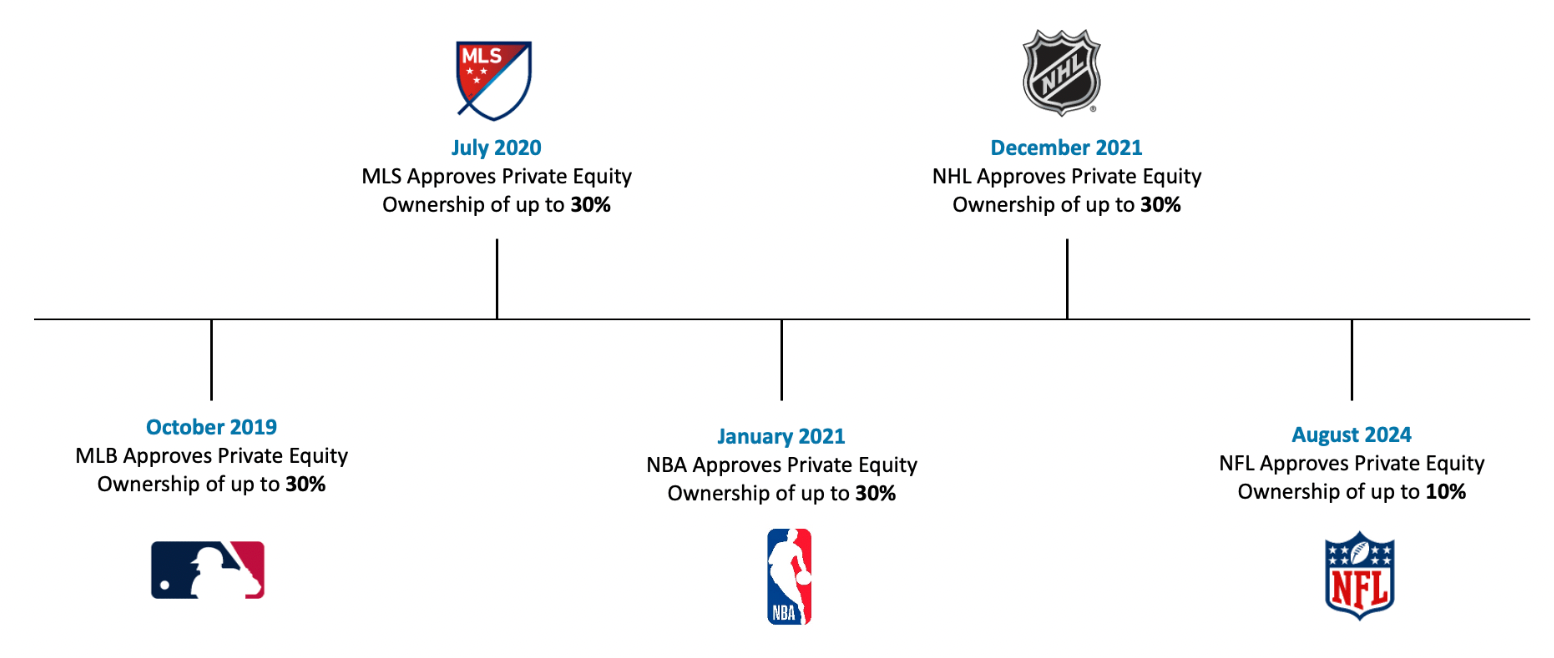

But that’s changing quickly. Major League Baseball opened the door first to institutional investment in 2019, allowing private equity to take ownership stakes. The pandemic then accelerated the trend, as the sudden collapse in game-day revenue reminded owners of the value of flexible and diversified capital. Even the NFL, long the most protective of its ownership structure, eventually followed suit in 2024 as soaring valuations made individual ownership increasingly out of reach. By the end of that year, private equity had at least some involvement in over half the franchises in the NBA, MLB, and MLS.

Why Sports Has Such Strong Staying Power

The most obvious reason is that sports have something most businesses could only dream of: customers who are emotionally invested. Fans don’t just buy a product; they identify with it. If Apple released a terrible iPhone, consumers would switch to Android without hesitation. But in professional sports, loyalty overrides logic. Even when teams underperform, true fans keep showing up, buying merchandise, and watching games.

In the major U.S. sports leagues, there’s an additional layer of protection. Teams aren’t at risk of relegation, which guarantees stable access to (inter)national media revenue far into the future. Restrictions on player salaries (such as salary caps) further protect profitability, keeping costs contained and ensuring that even poorly managed franchises can remain financially viable for decades.

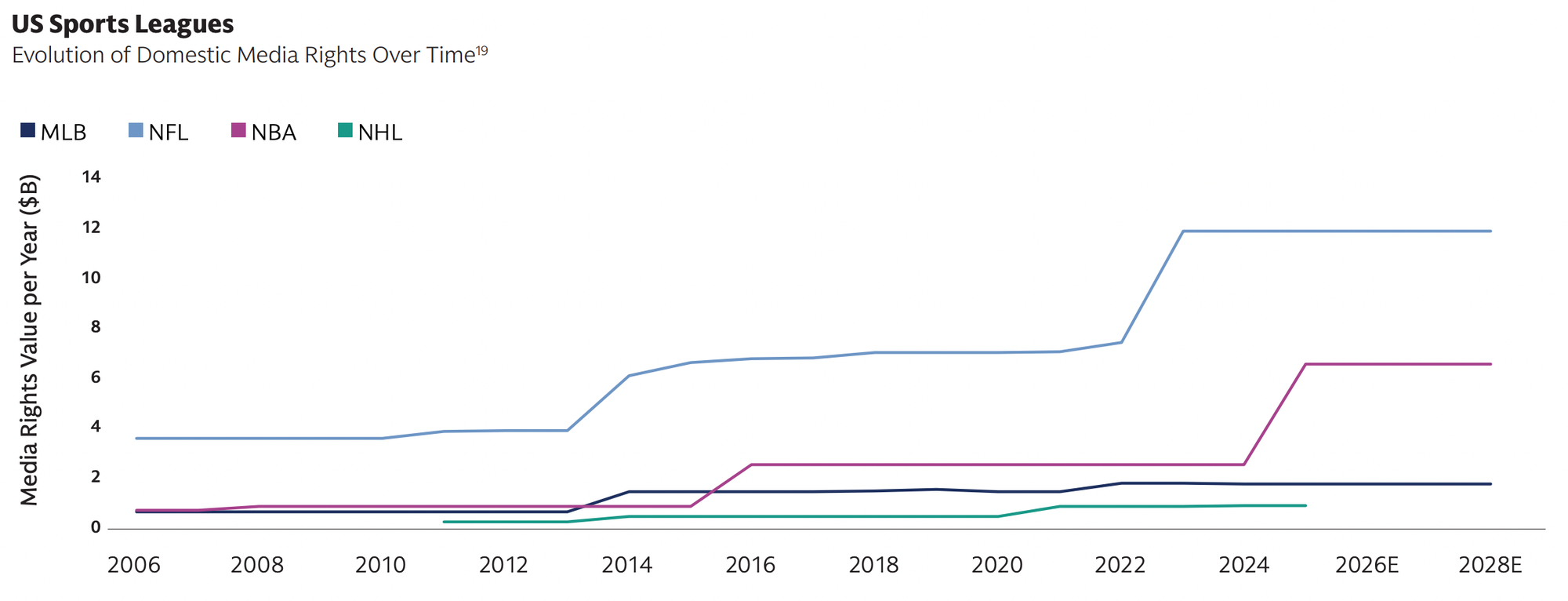

The business case gets even stronger, starting with media rights, which have become the engine of modern sports economics. In an era of cord-cutting, sports are the last form of entertainment that reliably commands live audiences. That makes them priceless to broadcasters and advertisers alike. No other content has the same resilience; even as viewing habits shift, sports continue to capture attention in real time.

Why There are So Many Growth Opportunities in Sports

The growth opportunity once again begins with the evolving media landscape, which has already been the major growth driver for the sports industry. As technology giants like Netflix, Amazon, and YouTube compete more aggressively for premium content, the value of sports broadcasting and streaming rights has surged. At the same time, social media has amplified fan engagement and expanded monetization opportunities, turning every highlight and headline into a global moment within seconds. The rise of the creator economy further accelerates this shift, as does the rapid growth of sports gambling.

Beyond media, sports leagues themselves are becoming increasingly global. The NFL has been staging regular-season games outside the United States for more than 20 years, while the NBA is exploring the creation of a professional league in Europe. This international expansion is powered by digital distribution, allowing teams to reach audiences far beyond local broadcasts. Star athletes and major franchises can now capture global attention faster than ever before.

Some areas of the market show especially strong momentum. Women’s sports have seen explosive growth, fuelled in part by star players like Caitlin Clark, while emerging sports such as pickleball continue to move firmly into the mainstream.

Why Private Capital is Such a Good Fit

In many ways, the sports world is still catching up to the opportunity. This is to be expected, in a world dominated by entrenched individual owners and longstanding traditions. Formula One is a prime example, with Bernie Ecclestone (now 95 years old) controlling commercial rights until 2017. Then under institutional ownership, a modernization to the business, and a hit show on Netflix, Formula One's business has taken off like a coiled spring.

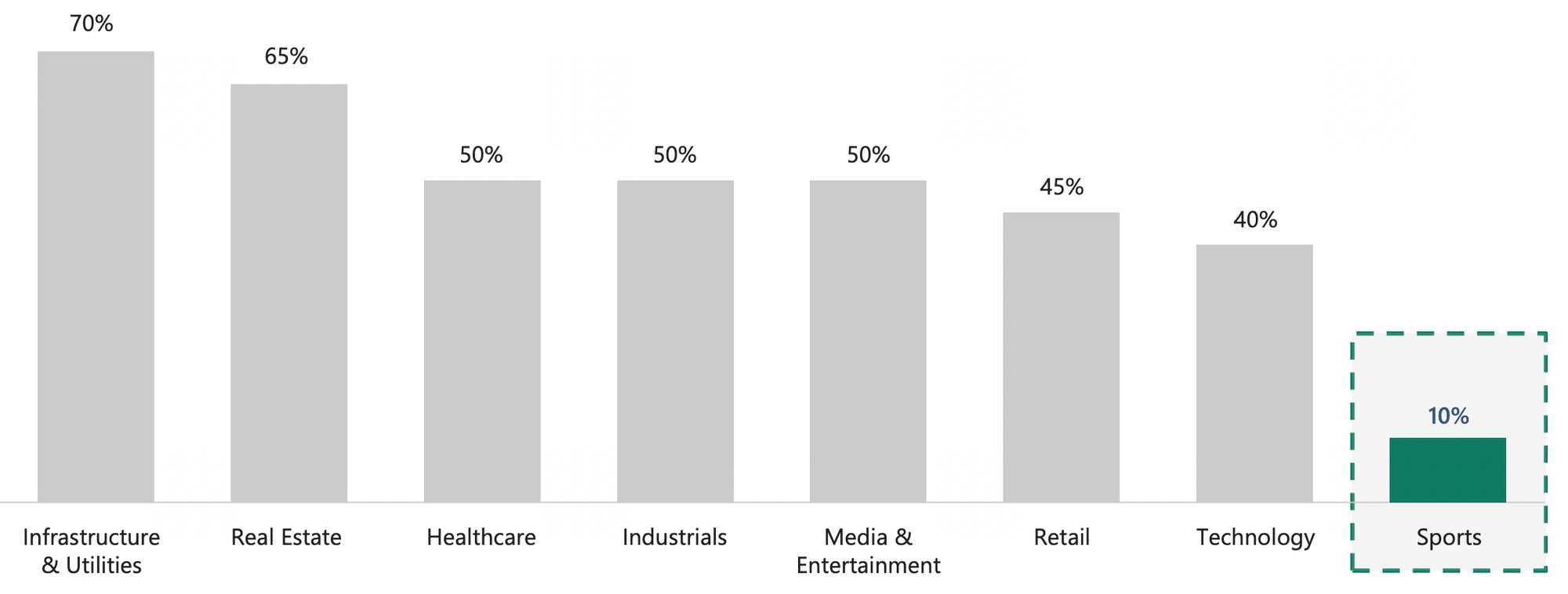

One big case in point is the teams' balance sheets, which are still very under-levered, particularly for a businesses with such strong revenue visibility and staying power. According to Apollo, loan-to-value ratios are still only 10%, well below other industries. If one considers a league such as the NFL, where a profitable year is all but guaranteed, debt levels could be far higher to support various expansion opportunities or free up cash. This is another opportunity for private markets to step in with debt financing or other creative forms of capital.

Average Loan-to-Value by Sector

What Does the Future Hold?

Put simply, sports is an exceptionally attractive industry that is still modernizing, which helps explain the interest from private markets firms.

In the coming years, individual investors should expect to see far more exposure to sports leagues and franchises in the funds they already own. If deal activity continues to build, a dedicated, sports-focused fund aimed at individual investors may not be far off.

However the landscape evolves, one thing is becoming increasingly clear: the business pages and the sports pages are now telling many of the same stories.

Podcast Update

On Friday, I recorded episode #5 with Andrea Gruza, President and Managing Partner at Bonnefield, a leading provider of land-lease financing for Canadian farmers.

We talked about her background, farmland as an asset class, the state of farming in Canada, ESG considerations, and many other topics. Next week's newsletter will contain part 1 of the conversation, with the full episode to be released shortly thereafter on Apple and Spotify. Then as always I'll post some video clips of the interview to LinkedIn. So stay tuned!

|

|

Want to find out more?

Private markets are not for everyone, and come with a number of risks, such as higher illiquidity and less transparency.

However, many of the world’s leading institutions and wealthiest families put a big emphasis on private markets, and recently these strategies have become more available to individuals too. Drawing on my background as an analyst specializing in private markets, I help investors cut through the complexity and understand how to build portfolios incorporating these strategies.

To explore whether these strategies are suitable for you, please schedule a 30-minute virtual meeting below:

Disclaimer

Benjamin Sinclair is a representative of Designed Securities Ltd. Designed Securities Ltd. is regulated by the Canadian Investment Regulatory Organization (ciro.ca) and is a Member of the Canadian Investor Protection Fund (cipf.ca). Investment products are provided by Designed Securities Ltd. and include, but are not limited to, mutual funds, stocks, and bonds. Benjamin Sinclair is registered to provide advice and solutions to clients residing in the province of Ontario. For more information, please see www.beyondtheexchange.ca/disclaimer/