3 Reasons Private Markets Are Poised for Growth Among Canadian Investors

I talk to business owners quite often in my line of work, and I always like to ask them a simple question: what if their company had to go public, and they had to report their financials (along with plenty of other sensitive information) every three months? Each time, the reaction is a clear “no thanks.” But it raises an interesting question: if business owners themselves dislike the public markets’ spotlight so much, why have most investors historically settled for only public stocks and bonds?

That landscape is now gradually shifting, as individual investors are finally gaining access to private investment strategies once reserved for institutions and the ultra-wealthy. This trend is still in the early stages, particularly in Canada, but there are no signs of it slowing down. Below are 3 reasons why:

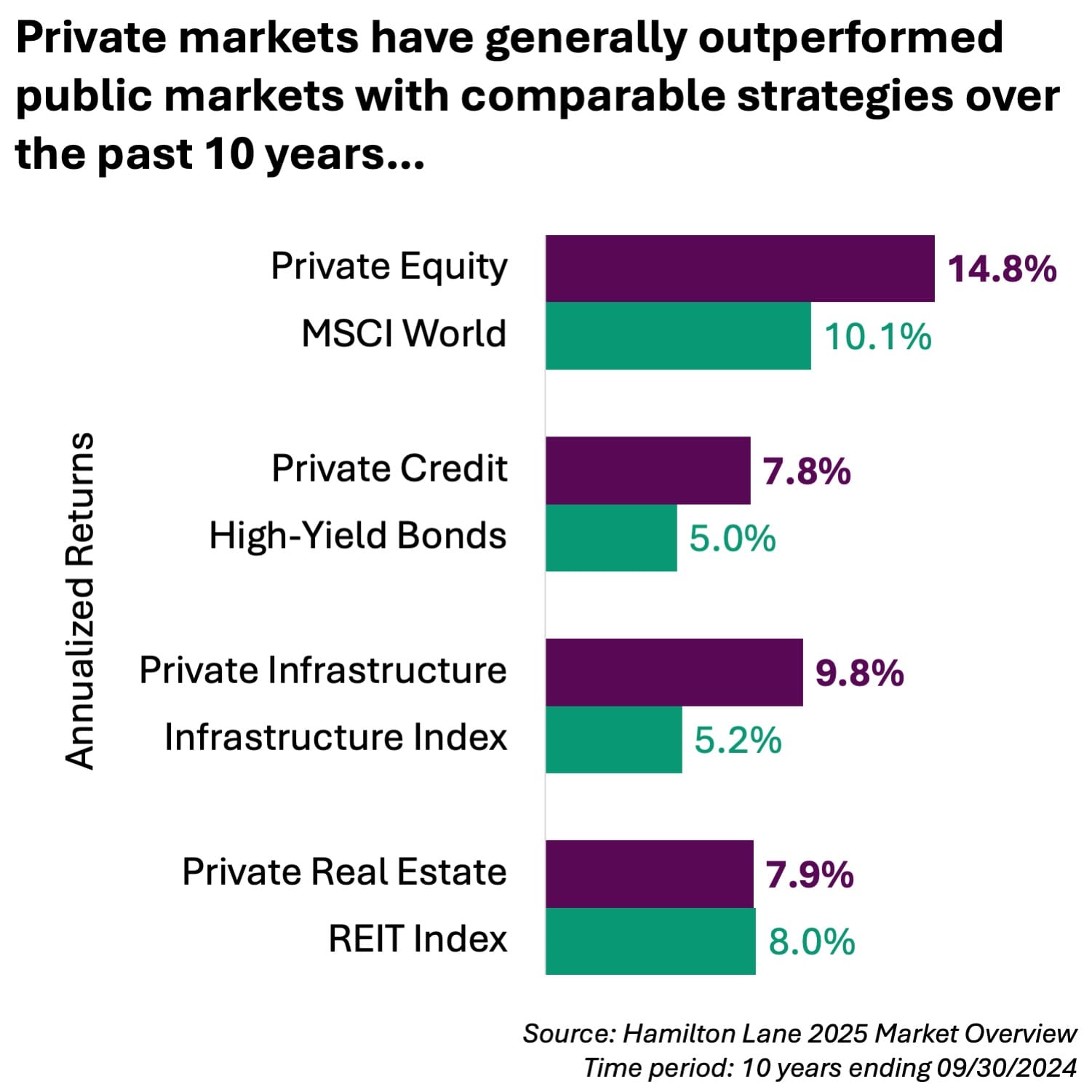

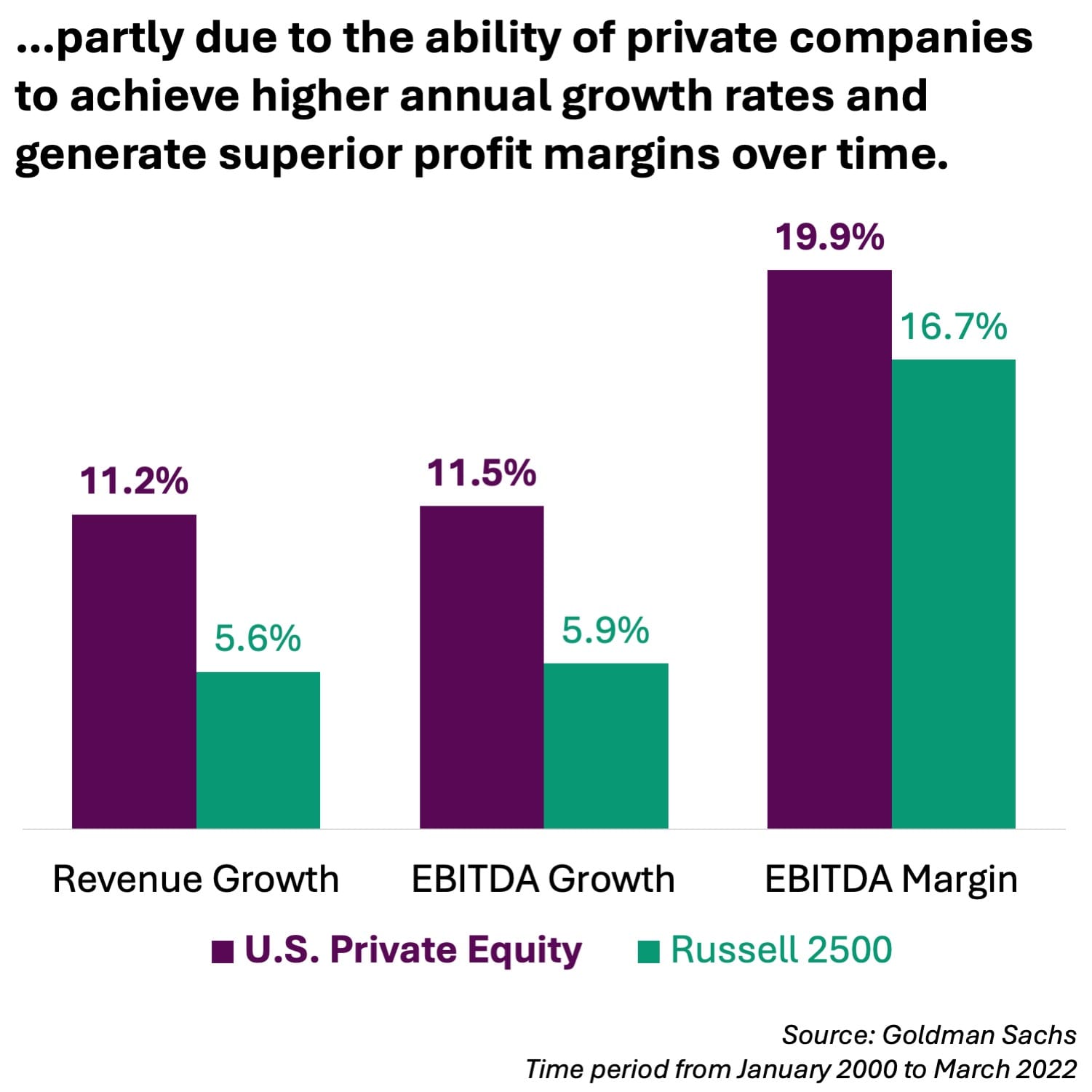

1. The Performance Gap

Numerous studies have compared the performance of public and private investment strategies, and the results are remarkably consistent: private markets come out ahead. For instance, Hamilton Lane has shown a clear edge for private markets, with the exception of real estate, which is more or less a draw. Several factors explain this. Unlike public companies, private firms aren’t as constrained by short-term pressures, and research shows they grow revenue and profits faster than their public peers. They are also often acquired at lower valuation multiples, partly because fewer buyers compete for each deal. This advantage extends across private credit and infrastructure as well. The tradeoff is (a lack of) liquidity. But for investors with a long-term horizon, giving up liquidity is a compromise worth making, just as institutions have long recognized.

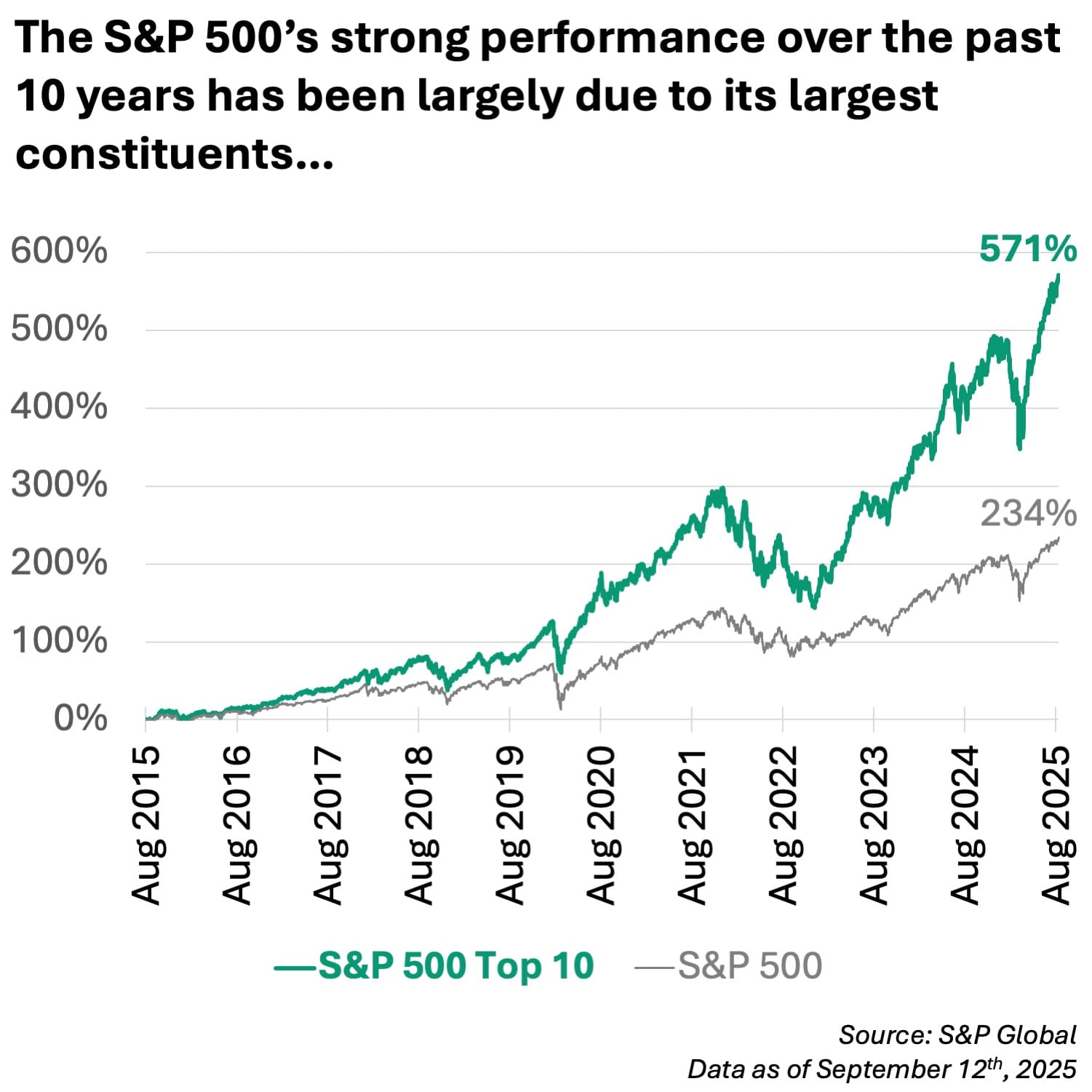

2. Problems with the Stock Market

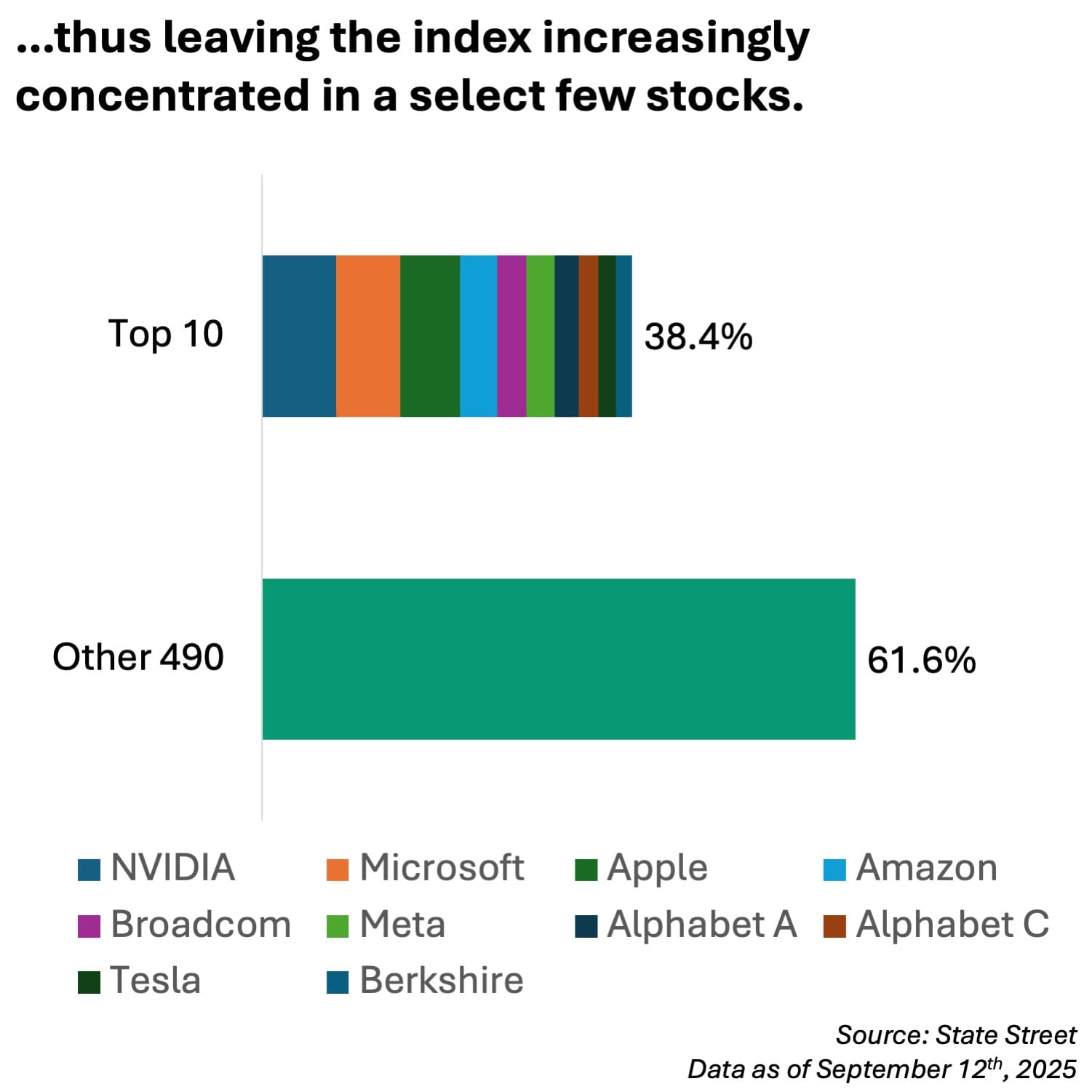

Public equities have delivered impressive returns since the Great Financial Crisis, but beneath the surface several flaws have emerged. For starters, much of the stock market's gains have come from a few mega-cap tech names (which now trade at lofty valuations), particularly when looking at the S&P 500. This leaves the index heavily exposed to one sector and far less diversified than many investors realize. Adding to the challenge, stocks have become more correlated not only with each other but also with bonds, making diversification that much harder to come by.

At the same time, active managers have mostly failed to beat their benchmarks, and individual investors often fare worse, underperforming the very funds they own due to poor timing and excessive trading.

This raises some critical questions. If liquidity often works against investors by encouraging short-term behaviour, is it truly the advantage it seems? And after more than a decade of strong equity markets, how prepared will investors be when the next bear market finally arrives, especially if their savings are concentrated solely in stocks?

These questions are easy to ignore while markets rally to new highs, but when the tide turns, investors relying only on public markets may find themselves dangerously exposed.

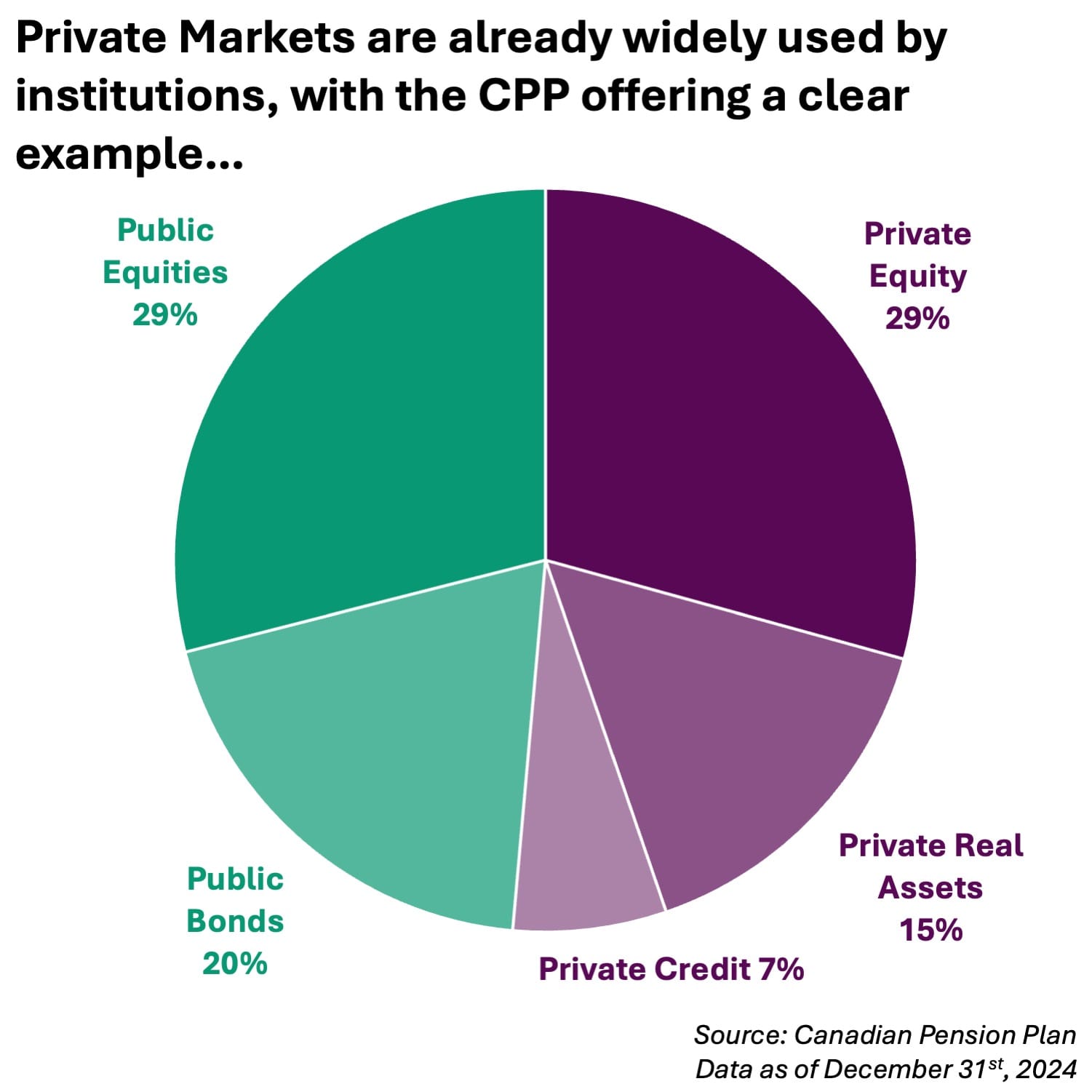

3. Private Markets are already widely used elsewhere

Private markets remain unfamiliar to most individual investors, but institutions have relied on them for decades. The Canada Pension Plan is a perfect case in point, with approximately half of its portfolio in private markets.

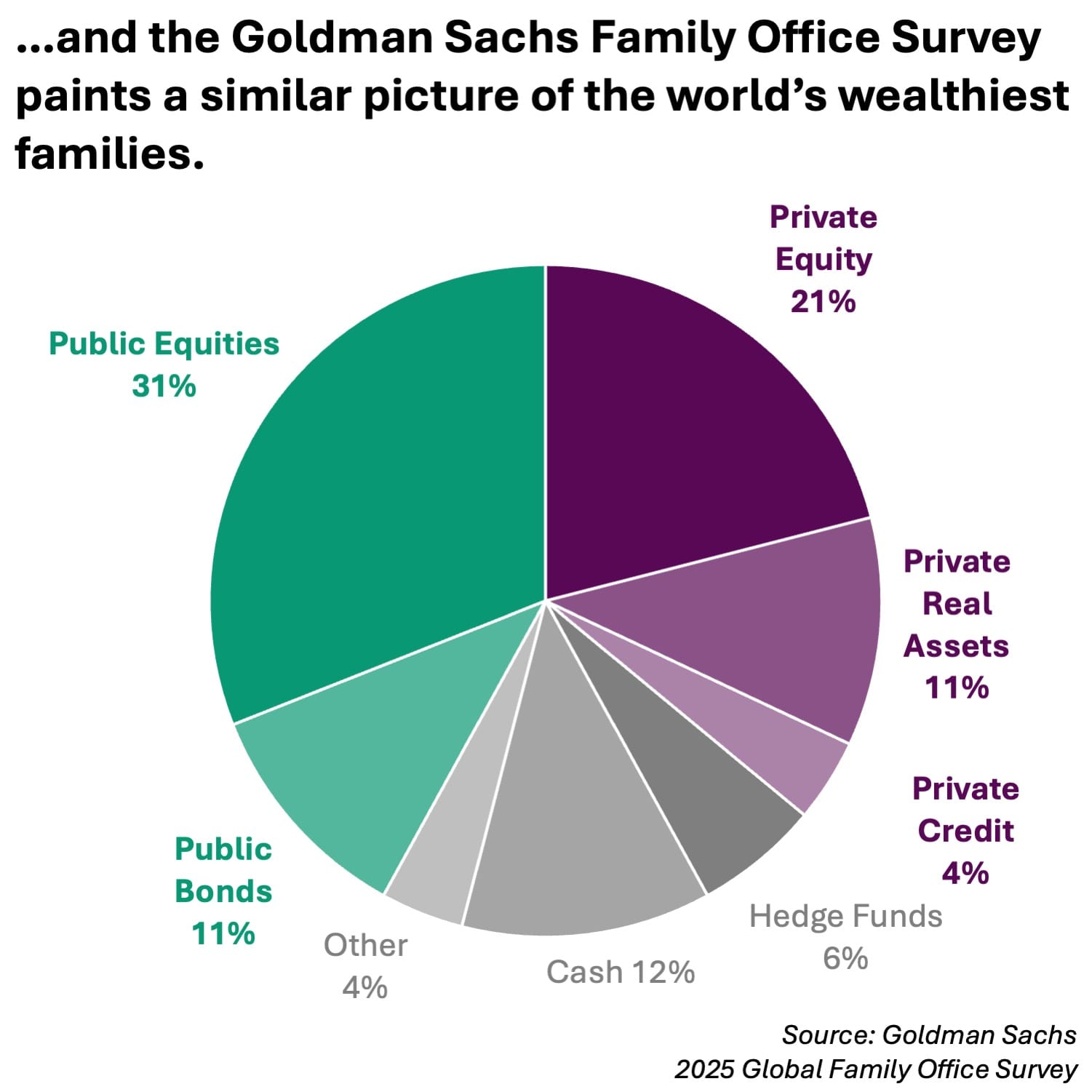

Likewise, surveys of family offices show that the world's wealthiest families commit a roughly equal portion of their savings to public and private markets. So it's no surprise private markets are drawing more attention from individuals. After all, goals like building wealth, managing risk, preserving assets for future generations, and generating income aren’t exclusive to the ultra-wealthy; they’re shared by everyone.

The problem was that historically, private markets were out of reach for most people. High minimums, onerous structures, and limited access kept individuals on the sidelines while sales teams focused on much larger clientele. But that landscape has changed dramatically. Today, major private market managers are designing funds with more practical structures and reasonable minimums. Meanwhile technology platforms such as iCapital are connecting managers, advisors, and investors. Regulators have also become more supportive, easing restrictions for individual investors.

While awareness and education remain obstacles, the first major barrier (product access) has largely been removed. With a very long runway for growth ahead, private markets are no longer just for institutions and family offices; they’re becoming a core consideration for individual portfolios too.

Want to find out more?

Private markets are not for everyone, and come with a number of risks, such as higher illiquidity and less transparency.

However, many of the world’s leading institutions and wealthiest families put a big emphasis on private markets, and recently these strategies have become more available to individuals too. Drawing on my background as an analyst specializing in private markets, I help investors cut through the complexity and understand how to build portfolios incorporating these strategies.

To explore whether these strategies are suitable for you, please schedule a 30-minute virtual meeting below: